One of the most frequent queries I get is around how should one go about researching a stock? And this is one of the most time-consuming parts in the overall investing process, and thus having a good structured approach here holds a lot of value for investors.

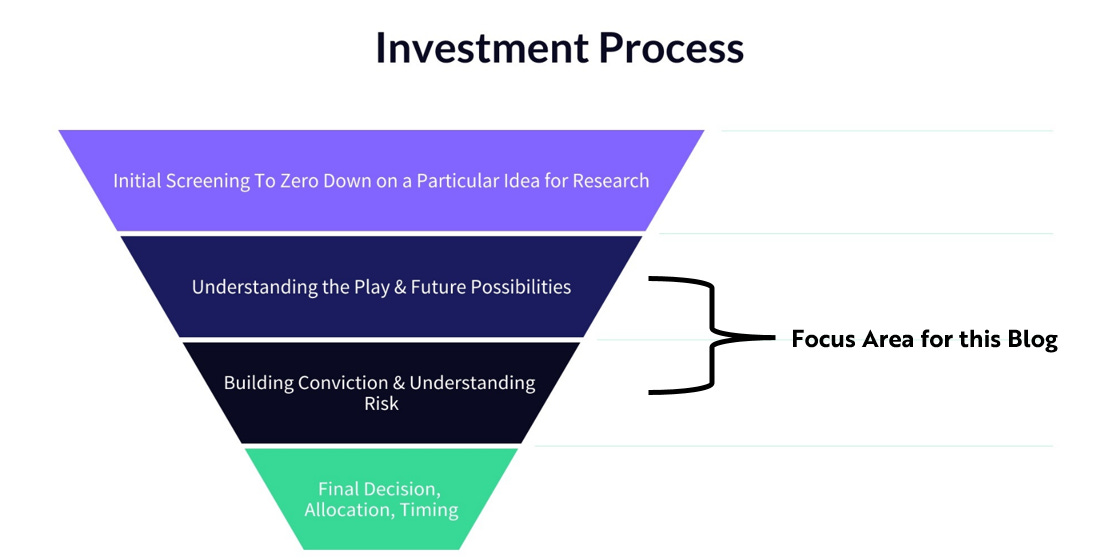

In this blog, I will lay out some key insights that investors can use to carry out their research on a particular stock. Here I am assuming that investors have already carried out their initial screening and zeroed in on a particular idea for further research (initial screening itself is a gruesome process and should be part of a separate discussion).

Now, the end goals of the whole research are two-fold, first is around figuring out what is the play or say the future possibilities in the stock and second is building conviction around the probability of such future play materializing.

And herein lies one of the best hacks in the research process.

Read the complete blog here-

https://www.surgecapital.in/post/how-to-go-about-researching-a-stock

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e