Hey! In this post I’ll be talking about one of the primary issue/dilemma that investors face in the equity markets and also share some thoughts on the current & possible near term market environment.

Most of you would have heard the statement that- “Investing is more Art than Science”, which is very true. But the statement does not highlight why is it so.

I have always used the analogy of alphabets to explain the same. In most kind of work, if you learn the A,B,C,D to Z of that specific work, you can say that you can do that work and atleast be good/average at it.

But this just doesn’t work in the markets, even if someone learns the A,B,C,D to Z of the markets he/she cannot say that they are good/average in the markets. This is because investing is not a fixed process wherein same thing can be applied to every stock. Different things work for different parts of the market and different things works at different times in the market. Even more, most things are applicable with varying degrees in market.

So, for example, basic thought in the market is that Insider Selling is a bad thing. However, an insider who’s nearly entire wealth is in the form of the company’s share, selling some shares to meet some expenses is not a big deal. So, the rule then becomes that the size of selling is to be seen. But even this will not work quite a number of times.

We have seen something similar happen in case of Laurus Labs recently wherein post quite large selling by Insiders, instead of stock performing poorly, the stock has done quite opposite.

And finally in markets one is competing with everyone. So if everyone else also knows the entire A,B,C,D that you know, then you won’t be able to make money as that would already be known & discounted.

So, an investor is in a constant dilemma about-

1. Whether a particular process/rule/thought works in the market?

2. Even if something has worked historically, whether it will work in the current market?

3. And even if does work, to what extent will it work?

I have been facing a similar dilemma in recent time. Over last 6-months or so, I have been wary of the relatively high valuations in the market; not because I believe that Market will top out or something but because high valuation levels reduce the opportunity to generate incremental returns from stocks substantially.

My understanding has always been that businesses that can grow earnings at more than 20-25% for long periods of 3-5 years or more are extremely-extremely rare, most of the best names will end up 20-25% earnings growth. Further, no one is right 100% of the time and thus even with a bunch of best names with 20-25% growth, the overall portfolio growth would be less than 20-25% from the earnings point of view. So, if one wants to generate returns of 20-25% or higher in the long run, re-rating of valuation multiple is very important.

So having a portfolio wherein the valuations are rich and thus has relatively lower possibility of valuation re-rating, I had to find companies wherein I could get valuations re-rating as well in order to get the 20-25% or more kind of returns on the portfolio level. So, the quest of finding relatively lower valuation companies started; and small companies that are yet to be discovered by the market is a good space to find such kind of relatively lower valued opportunities.

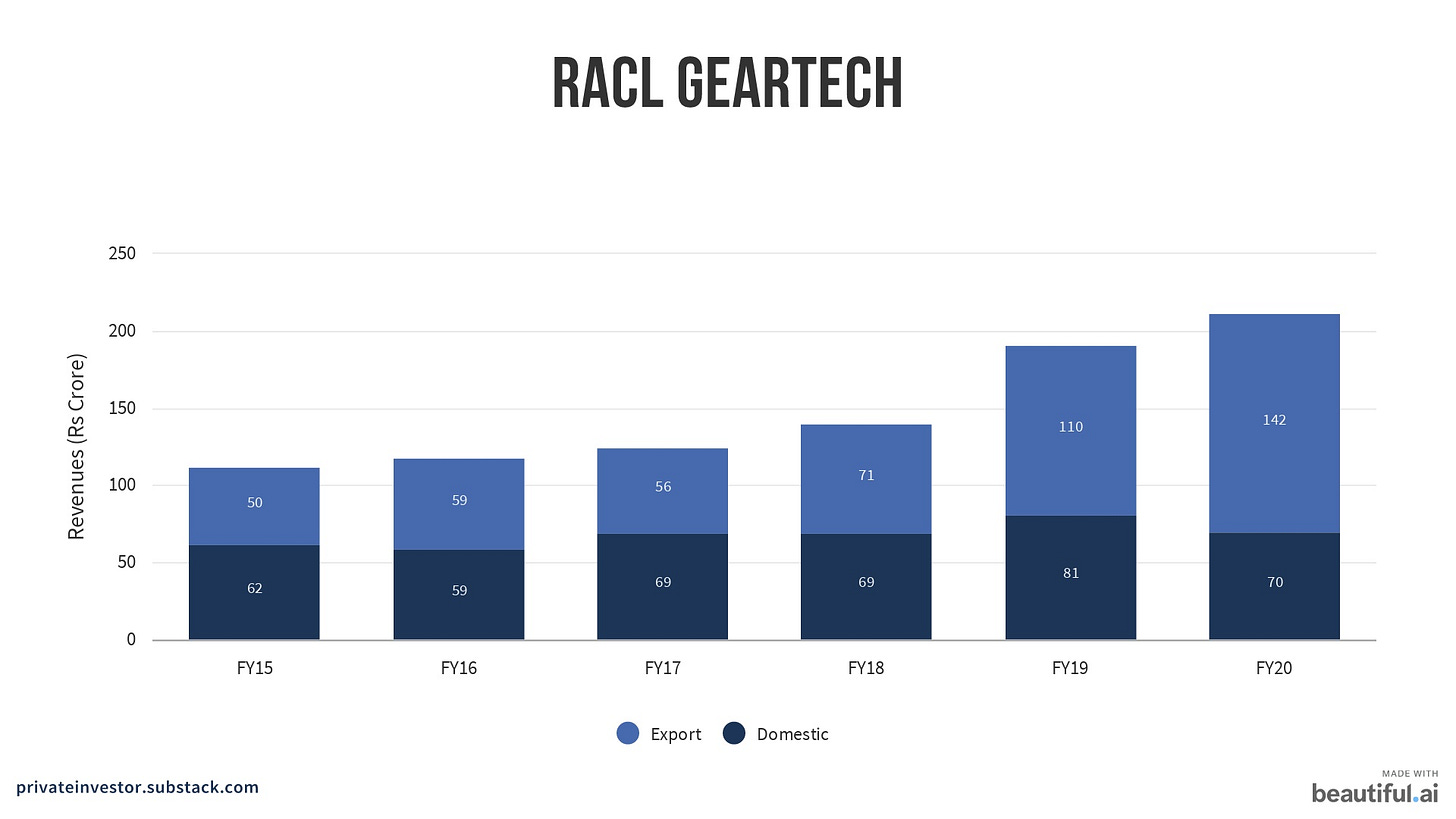

One of the companies I zeroed in on was RACL Geartech. RACL is probably the only Auto Ancillary that has grown in the last couple of years. It has a good business wherein they supply precision gears for high end bikes and other automobiles to clients like KTM & BMW. Catering to the high-end segment has allowed RACL to establish a sort of niche wherein they command relatively higher margins. Further, post many years of work for various high-end clients, RACL is finally at a stage wherein it could secure larger & longer-term business from its clients. Because, most high-end customers typically test smaller companies will small volumes over the years to test the quality and reliability of supply and once the company is able to establish a record of good quality and timely supply, the scope of the business expands dramatically. And same is being played out in RACL, company has recently secured a 10-year contract wherein RACL will be the sole supplier. Further the company has recently done a ~50 crore capex on account of the new orders received from new customers in Export market. The installation of machinery is in line with order specifications provided by new customers and is based on product approval from customer and thus the Revenue generation from this capex is secured.

The company is targeting Rs500 crores revenues in 2025 from ~200 crores in FY21. Plus, as the business scales up the margins for smaller companies typically expand and thus RACL looks good on a 25% growth for next 3-4 years. And the best thing was that it was available at <10 PE multiple, so the scope of rerating was there for sure. So RACL looked like a stock that would contribute to the goal of achieving that greater than 20-25% kind of returns.

However, I noticed that the company was not generating enough cash as working capital requirement was quite heavy. So, I tried to analyze the Cashflow statement to figure out the issue, but in process I discovered something big.

The figures in company’s cashflow statement did not add up.

A cashflow statement is typically prepared by taking pre-tax profits, adjusting for non-cash items and working capital and then reducing the cash paid to get post-tax cashflows. In case of RACL, they started with post-Tax profits (which is also fine), but then they were again adding back the taxes paid, so the cashflows here seems to be inflated by the taxes paid. And thus, the cash on the balancesheet itself might also not be correct.

Now, I am not saying that there is some outright hanky-panky going on in the company, but when a company is not able to convert profits into cash and then you figure out that the cashflow statement figures do not add up, then it becomes a big red alert.

Normally, in smaller companies one needs to be more vigilant given a higher possibility of promoter’s doing shady stuff, but I am also aware that most smaller companies do not necessarily pay attention to a lot of details including accounting, and thus in-consistencies cannot be constituted as an outright wrong intention.

Based on company’s response to this issue, I get a feel that they themselves do not understand how the accounting works and thus this might not be something intentional.

But more than that, I cannot ignore the fact that the cash on the balancesheet might be wrong as the closing cash on the balancesheet is based on opening cash adjusted for this wrong cashflow.

So, this is where the dilemma is, on one hand you want to be more careful in case of small company, but you also want to ignore some of the in-consistencies.

Meanwhile, the stock price has tripled from the time I gave it a pass, as market discovered the stock the valuation multiple has moved from single digit to 25x now.

And this not an isolated example, there are many such stocks wherein I had faced the same dilemma.

Either way, I have two conclusions from this-

1. That I am too focused on smaller aspects of a company and I need to give a larger benefit of doubt or say give more slack to smaller companies.

2. Or, the market is in a situation wherein it is too forgiving such that such issues do not matter currently, but in the larger scheme of things it is right to avoid stocks with possibility of issues.

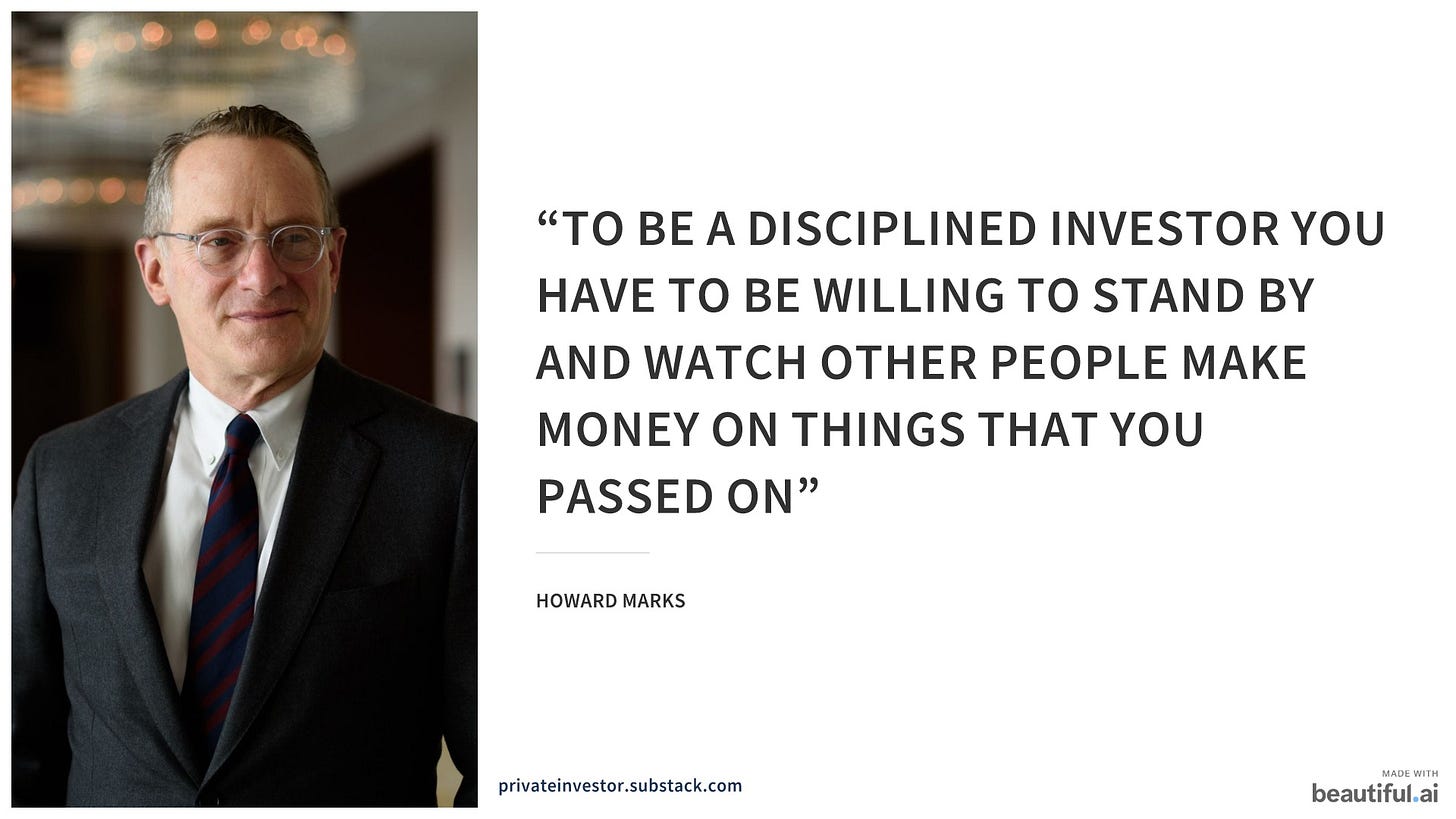

The only way to address this dilemma in investing is to follow a certain process and also practice something that Howard Marks says-

Zomato and Upcoming Listings Of Unprofitable Tech Companies

Listing of Zomato and given the relative success of its IPO till now, it has put the entire market into overdrive wherein a lot of unprofitable tech companies are lining up to list as fast as possible in a market that is already quite charged in terms of valuation levels, liquidity and increased participation.

There are largely two sets of market participants currently, first are those who are adamant that companies like Zomato with no profits having market cap in billions of dollars is absolutely nuts and then there are another set of people who think this is the beginning of many years of tech bull run and are ready to lap-up on all upcoming tech IPOs.

I have always believed in Peter Lynch’s quote that-

“Far more money has been lost by investors preparing for corrections than has been lost in corrections themselves”

Similarly, I believe a lot of opportunity is lost in the markets cribbing about market madness and thus I look to stay invested even in such kind of market, though with an increasing sense of caution.

I believe that the job of a market participant is to make the best use of whatever opportunity market is providing you, but I never think that I’ll be able to capitalize on an opportunity to the fullest without also having to also bear substantial part of downside of such opportunity.

All of those how are full gung-ho on the possibilities/opportunity of these tech companies will be able to capitalize the market opportunity to the fullest, but will also have to bear the downside that will follow once the opportunity has run its course, which it inevitably will (don’t think so? Think Again).

And then those who are going to sit on the sidelines would miss out on the entire opportunity and sure will also be able to avoid the downside that will follow post that. But I am not sure that this is even possible as for the most part; many people who avoid the opportunity initially, jump at the later stage as the emotional stress of missing the opportunity is too big to handle.

If one reads about the tech bubble as well, we had similar instances wherein as early as 1995, many of the market participants were calling out the extreme valuations of the initial Dot.com companies given the lack of understanding of the business that these companies were doing and also the fact that for the 1st time loss making companies were getting listed with rich valuations, this was simply out of most people’s understanding.

I recently came across this tweet which perfectly highlights how some of those companies really went out of the traditional business norms and proved that loss making companies can also scale, sustain and create large economic value.

Today as well, most people are making the same argument for say Zomato, that how can a loss-making company command such valuation. But above example of Amazon is a perfect example of how some of these companies can pivot to something that no one is even thinking about at the moment. I am not saying that it would be Zomato, but I am quite confident that select few companies of the many IPOs that will come out over next year or so, will pivot to something big, defying the traditional business dynamics of profits led growth. But there would be many-many failed companies for every such pivotal company and such companies would be evident only post the bubble’s burst; if we end up in a bubble.

The dilemma that comes now is whether to sit on the sidelines or go all in on such stocks? Well, that’s a tough one, because there is no perfect way to get in on the action without taking on the risk as well. The problem with going against the market is that a lot of times market does gets things right and even if the market is wrong, it can stay wrong for a long period.

A basic strategy to participate in such an environment is to-

1. Use a basket approach- Buy smaller % across a number of such stocks.

2. Do not jump upfront- Let the listing happen, wait for stock to consolidate for few days post initial listing and then once the stock starts moving again, get in. This I believe is a good way because it allows you to let the market discover & settle for a price which then acts as a base for you and also helps avoid the initial volatility.

3. Do not try to capitalize on the entire move- Be cautious and get out on any signs of price breakdown. Remember even the likes of Amazon corrected 95% from the Top, so even the companies that would survive & pivot to something big can see massive drawdown depending on the scale of up move.

I truly believe that coming time in the market is going to be one of the most difficult from the behavioral/emotional point of view. And that there would be an opportunity to make massive amount of money in a short period of time as well as the risk to lose massive amount of money in a short period.

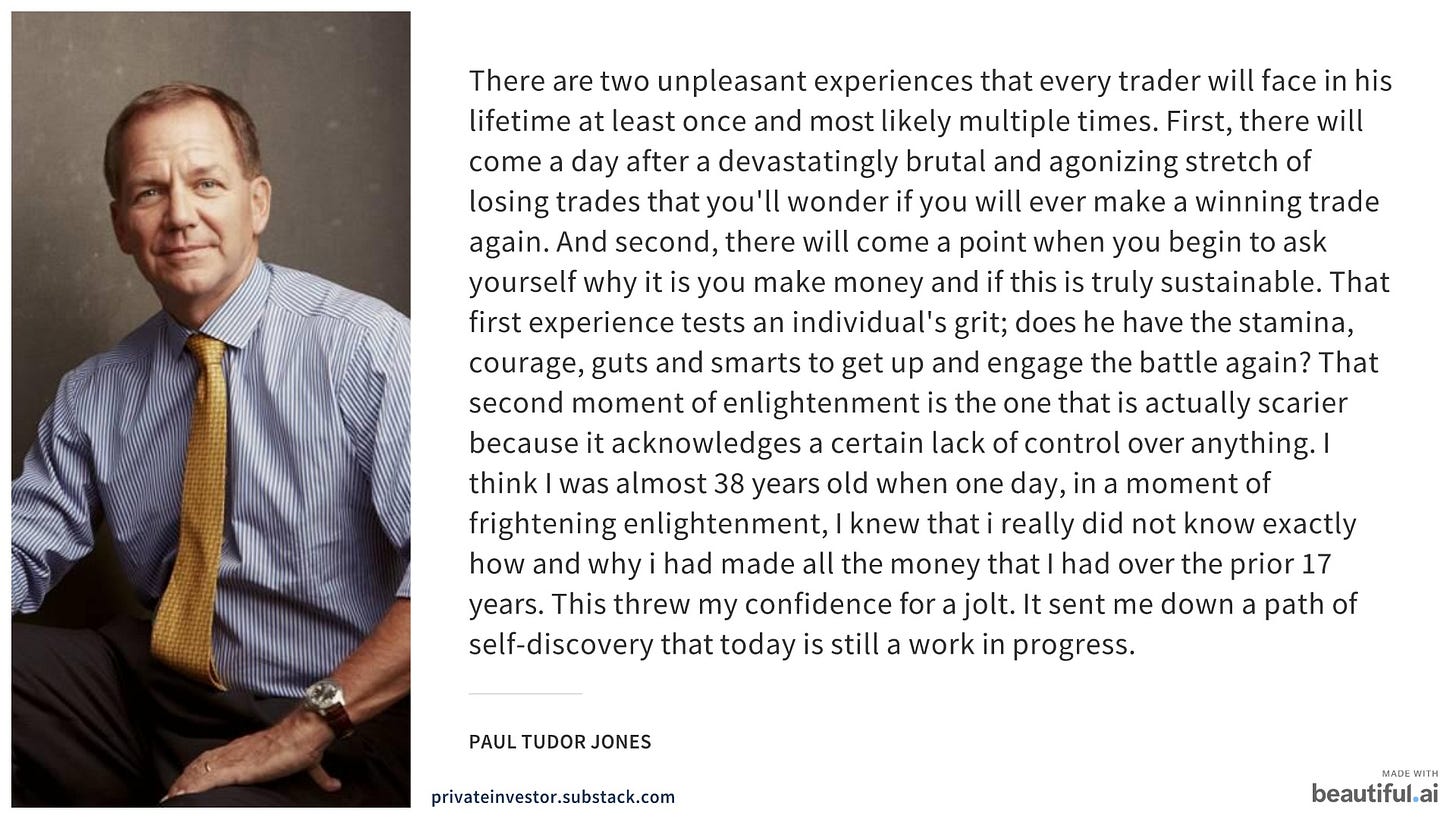

Finally, I’ll leave you with this statement from Paul Tudor Jones-

Very Well written. Good wisdom especially from a person of your age. I think Zomato's business can easily be broken by a competitor App because they don't have anything much in assets except a famous App. Apps are getting replaced easily(even big mightly Whatsapp is getting replaced by Telegram). However similar thing cant be said for loss making companies like Indigo who have assets base like Team, Aircraft etc. Hence long-term probability of Indigo doing better in comparison to Zomaro is higher.

Read your article on the power sector and followed you here. A small time investor, late entry at a late age. I appreciate thought processes. I find that those have helped me far more in my investing journey rather than any recommendations or predictions. I have stopped believing in labels like "blue chips " among other things. For myself I have also learned not to believe in the "long term". It doesn't work in life in general and certainly doesn't appeal as a stock strategy for me. Neither do I trade on a daily basis. Defining an exit strategy for any stock I invest in is my current goal. When the percentage gain is way way over a 25 % return within a short time....how to get the hell out of there is what consumes me!