NYKAA- Common Traits Among World’s Leading Businesses

Not Just Another Generic Blog on the Company

In the 1st post of Nykaa, we had discussed the framework of Brands and how it is core to understanding the competitive advantage that Nykaa as a company has.

In this post, I want to talk about one very interesting framework that lists out key traits of some of world’s most successful companies and see how Nykaa really fits among most of these traits.

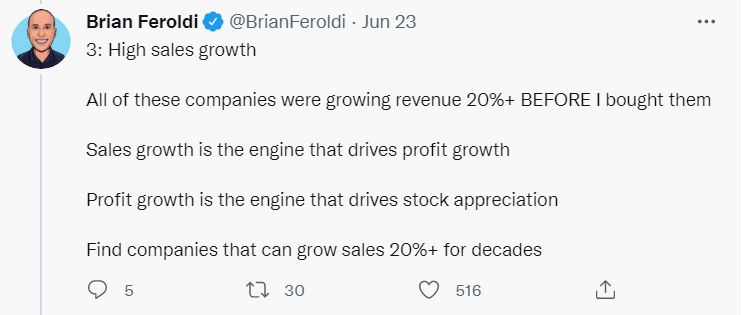

This framework was shared by Brian Feroldi sometime back on his Twitter handle, wherein he highlights that he has had seven 15X plus multibaggers and they all had these common traits.

TRAIT #1

Nykaa is led by its founder- Falguni Nayar. Nykaa is probably the only new age startups wherein the promoters hold substantial stake. Nayar Family would have >50% stake in Nykaa post the IPO; indicating skin in the game.

Brian mentions that founders tend to be detail oriented; well look at this leadership description on Nykaa’s corporate website.

One should watch this video to get a sense on how Falguni Naya fares on some of the qualities of founders that Brain has stated.

Another interesting thing to note here is that Falguni Nayar started Nykaa by quitting her job as an Investment Banker at Kotak Mahindra’s investment banking arm. You know who else has had a similar journey? Jeff Bezos (founder of Amazon) also worked as an investment banker before quitting the same to start Amazon. (Both went from Investment Banking to Online Retail 🙂)

TRAIT #2

Nykaa is digital consumer brand focused on beauty & lifestyle. It gets over 20 million monthly unique visitors on its Beauty & Personal care platform with over 7 million annual unique transacting customers. And this consumer traction has more than doubled over last 3-years.

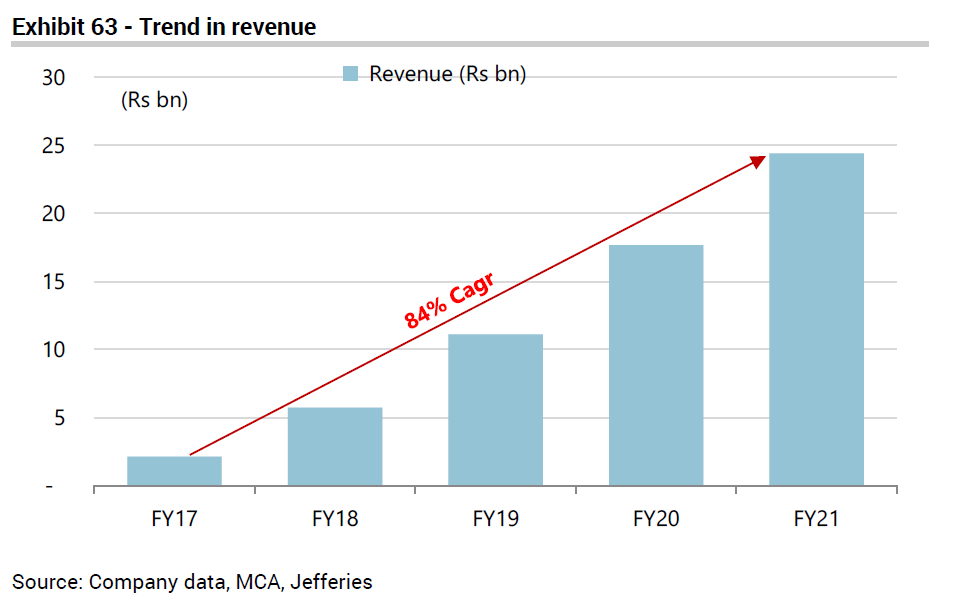

TRAIT #3 & #8

Nykaa has grown its revenues at a massive 84% CAGR over last 4-years. And it has massive opportunity to continue to grow for many-many years to come. The total addressable market will grow to over $150 billion in next 4-5 years and currently Nykaa is doing business of only ~$0.5 billion.

TRAIT #4 & #5

Nykaa excels in these two traits as well. It is hard to put some hard data around this, but qualitatively Nykaa as a brand has become synonymous with beauty products atleast in the online space.

TRAIT #6

Capitalmind has recently done a very good price comparison of Nykaa vs its Peers.

https://www.capitalmind.in/2021/10/nykaa-price-comparison-peers

Nykaa offers lowest discounts among its peers in various categories of Beauty products and is still a leader in this segment. This is a very good indication that the value provided by Nykaa is more about other aspects of product offerings, content, product authenticity etc, than the pricing itself; indicating that Nykaa does command pricing power.

TRAIT #7

I love Optionalities and I have extensively talked about them in many of my previous posts.

Nykaa also have Optionalities that it can capitalize on. It has already capitalized on one of such optionalities when it entered into the Fashion retailing back in FY19 and that has expanded Nykaa’s addressable market by many folds. The Fashion business now accounts for nearly 25% of Nykaa’s business.

One another optionality that can play out in near term is that of Geographical expansion. Nykaa has already talked about its plans to enter Europe and UAE, primarily to market its own Nykaa line of products.

Some other optionalities that can play out here can be expansion to some another vertical within the luxury & lifestyle space like it did with Fashion.

TRAIT #9

Nykaa does enjoy moat from its Brand and Network effects. Both of which would widen over time as Nykaa scales up and attracts more & more consumers to its platform. I have discussed these moats in the first part extensively.

TRAIT #10

This is something very hard to establish at the moment as culture is highly qualitative in nature and culture becomes more evident only when the company is under public radar for a good enough time. So hard to comment on this.

One last thing Brian mentions in his thread, which is not a company specific Trait but is something that we as investors have to keep in mind, in order to generate such multi-fold returns.

And I think this is required especially in the case of Nykaa which is getting listed at extremely rich valuations and would be even richer post the IPO Pop; which would make it susceptible to a major price correction depending on the broader market mood even if the business continues to perform well. Whether it happens in 1 year, 3 years or 5 years nobody knows.

Lastly, I want to say that it is easy to take a company and fit it into a framework and vice versa. But Brian’s framework is something that I believe any growth investor can relate to and Nykaa genuinely fits very well in it.

So that’s all for this one.

Now all that’s left is to cover finer aspects of Nykaa as a company- like different business models for its different verticals, marketing strategy, depth of involvement with brands, other various initiative around offline stores, B2B business, Global Store etc. Which I’ll try to cover soon, maybe post Nykaa’s Q2FY22 results.