INTELLECT DESIGN ARENA- PART 2

Beginnings & Incubation, Current Position and Future Possibilities.

In the 1st Part of this series, we had talked about Software Products as a business model and one of the major pivots that the industry is witnessing. In this post, I’ll talk about Intellect Design Arena at length, starting from its beginnings & incubation, current position and future possibilities.

Firstly, I’ll just explain a little of what exactly Intellect does and its product portfolio.

So, Intellect basically sells software to Banks & Financial services companies. Most of you would have heard about Finacle which is a core banking software used by most Indian Banks and developed by Infosys. So, Intellect is into the same business of making & selling such Software. And you guessed right, IT Services companies like Infosys and TCS are also into products business, but unlike Intellect which is purely into products, likes of Infosys and TCS have only a small portion of business coming from Products. Infosys in FY21 had a revenue of Rs7000 crores from Products & Platforms out of its ~1,00,000 crores revenues.

Intellect consists of four major business divisions totalling more than 14 products-

iGTB (Global Transaction Banking)- This is the largest and most matured product division of Intellect. It includes products targeted towards a bank’s needs around wholesale & corporate banking services like trade finance, liquidity management, payments etc.

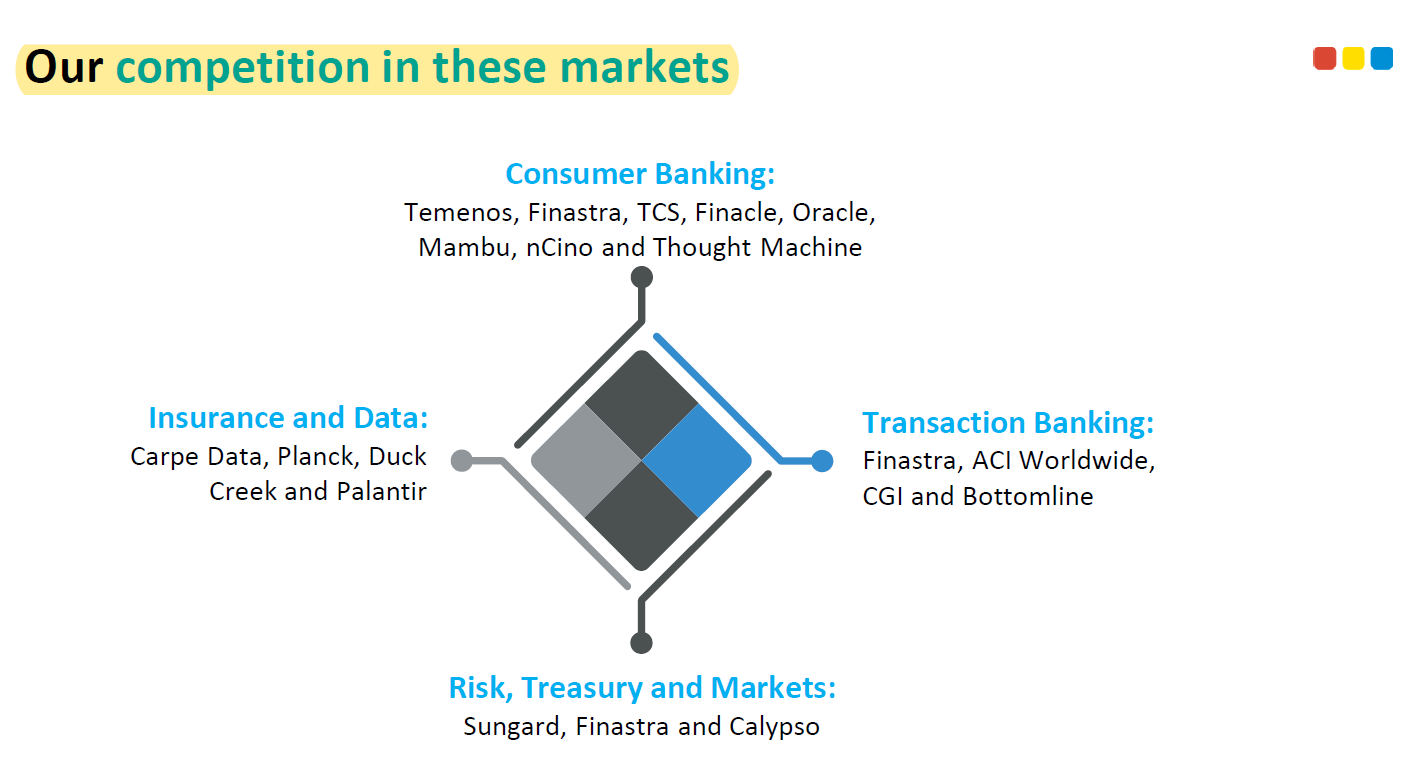

iGCB (Global Consumer Banking)- Products targeted towards a bank’s needs around Retail banking, private banking and Central Banking; like core banking software, cards, lending etc. Here Intellect competes with the likes of TCS, Infosys (Finacle), Oracle (Flexcube) and Temenos (talked about in 1st Part).

iRTM (Risk, Treasury & Wealth Management)- Solutions for a bank’s need around treasury, risk management and asset management. This is Intellect’s youngest & smallest product line currently.

SEEC (Insurance & Data)- Solutions targeted towards Insurance companies around distribution, underwriting and claims. This segment also extends to other areas of BFSI space for data solutions. Products under this segment are pure SaaS offerings.

Apart from above Intellect also has few other platforms like-

1. Government E-Marketplace (GeM), which is a platform developed & managed by Intellect (under a consortium) and is used by Indian Government for its public procurement of goods & services. Intellect gets a share of total value of goods & services procured through this portal.

2. iTurmeric- This is a recently launched platform which helps accelerate digital transformation process of a financial institution. It allows for progressive & incremental transformation to new systems without doing away with existing systems.

If you are interested in the technicalities of products, you can watch Intellect’s Technology Day Webinar (Tip: I personally did not understand much)

Now with some understanding around what Intellect does, lets understand how Intellect came to be and how it is positioned now.

Incubation of Intellect

The journey of how Intellect came to be is more of the journey of its founder & promoter Mr. Arun Jain.

Journey of Arun Jain starts in 1980s when he along with two of his friends-Yogesh Andlay & Vishnu Dusad started Nucleus Software Workshop (The Current Nucleus Software). Initially Nucleus was setup to provide services to Citibank. Overtime as business expanded, they jointly setup Polaris Software in Chennai headed by Arun Jain who at that point was looking after Citibank’s business while Vishnu Dusad was looking at Nucleus’s overseas business from Singapore.

Then in 1994, all three of them separated with Arun Jain getting Citi Bank’s business of Polaris, Vishnu Dusad getting Nucleus Software (overseas business) and Yogesh Andlay started Nucleus Sofware Engineering (a start-up incubator).

In one of the interviews Arun Jain highlighted that the reason for this entire restructuring was that he always wanted to create a global products company out of India and that Intellect would need a dedicated focus to make it happen. Also, according to him Polaris being an IT services company focussed on providing services to IP led BFSI players was resulting in a conflict as Intellect itself was an IP led company competing in BFSI space.

Intellect Post Demerger

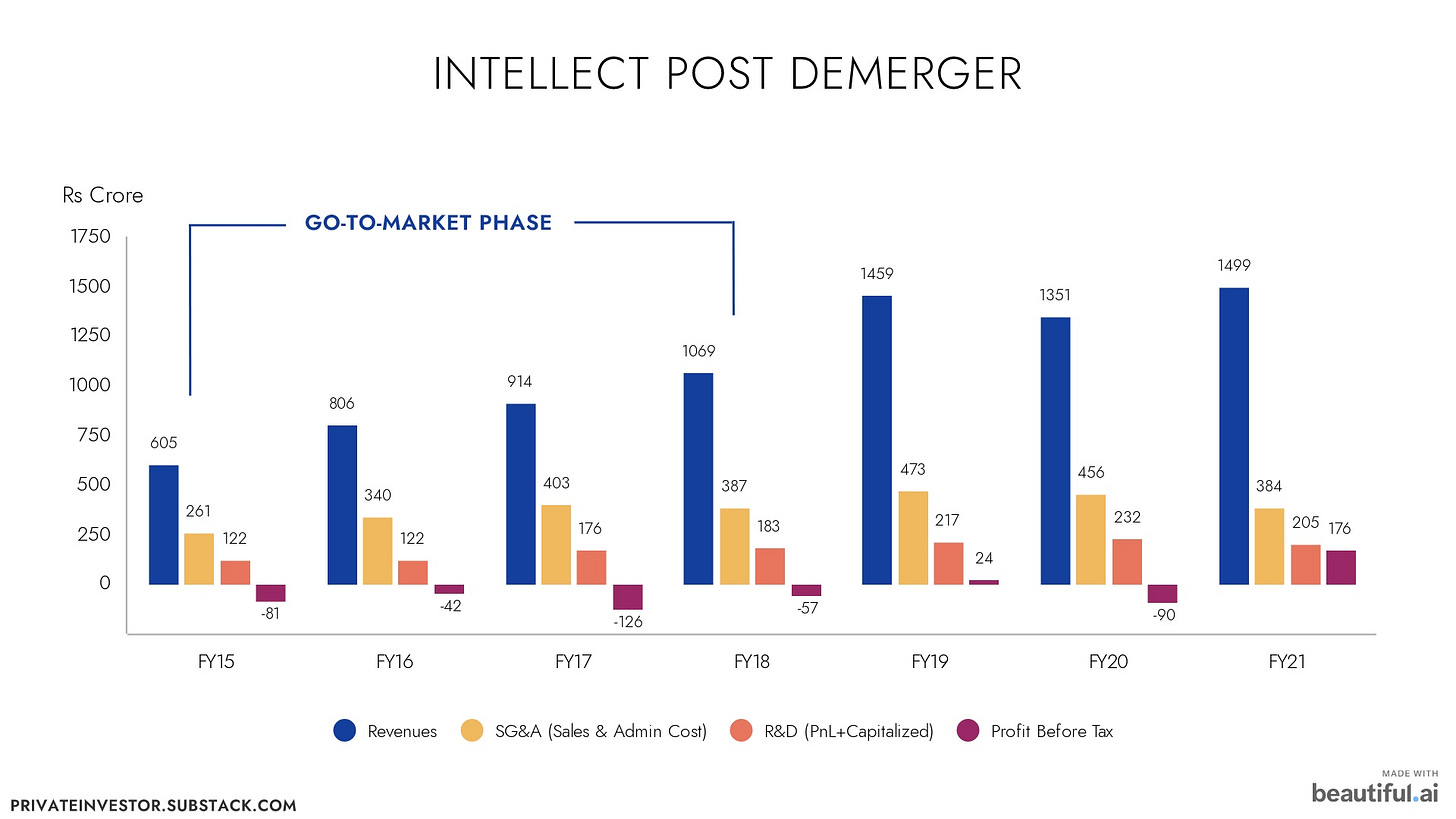

At the time of demerger, Intellect had revenues of ~550 crores and was making losses.

In one of the initial earnings concall of Intellect post demerger from Polaris, Arun Jain had stated that under Polaris, Intellect lacked dedicated thrust and investments in Sales & Marketing.

In the demerger memorandum Arun Jain had made the following point-

Our competition invests between 30-50% on Sales & Marketing. We invest 15% in Sales & Marketing. To be globally competitive, we propose to increase these investments in a focused and planned manner.

This set the stage for Intellect’s roadmap post demerger.

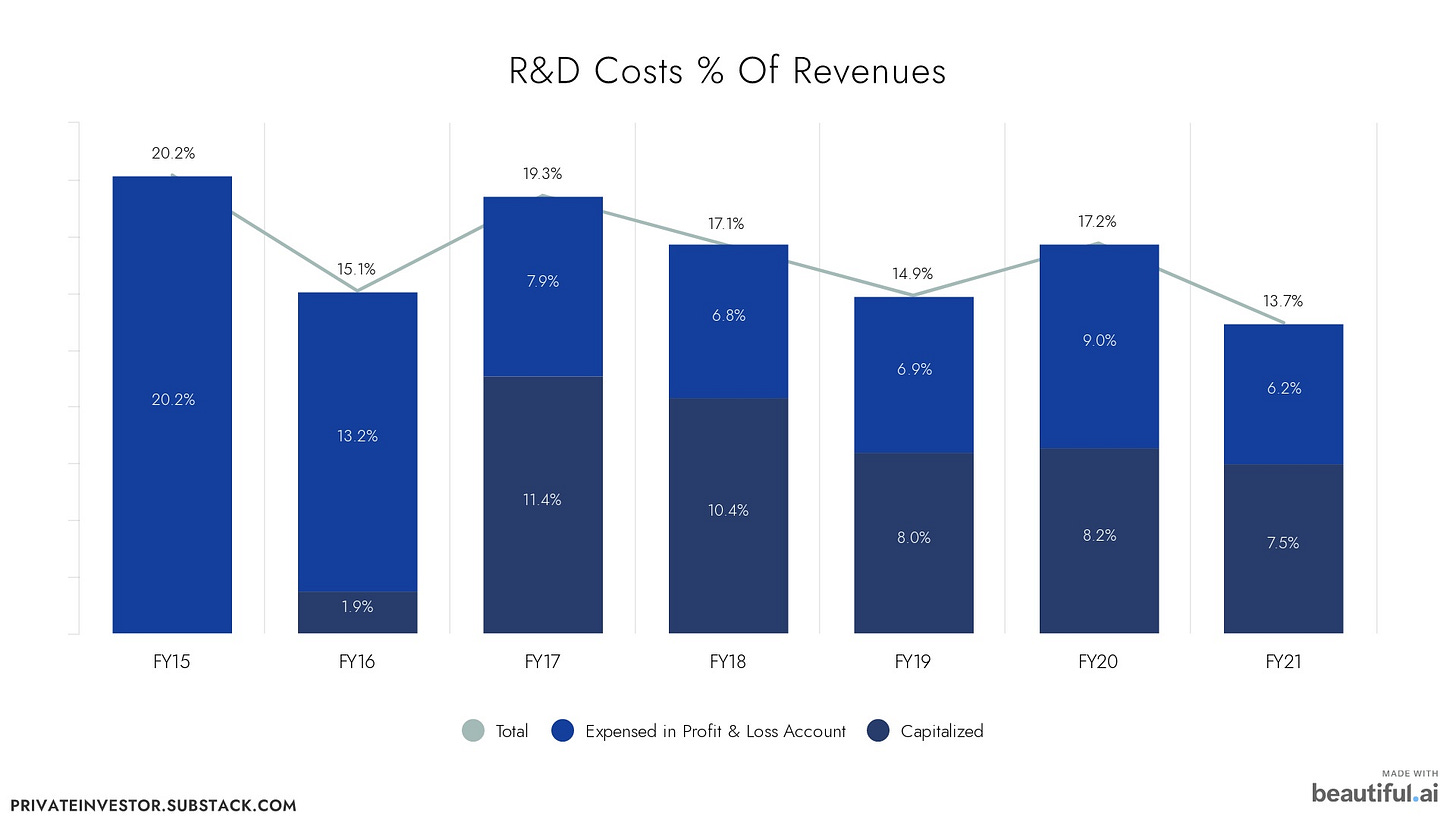

FY15-FY18 was Go-To-Market stage for Intellect wherein there were heavy investments in Sales & Marketing. Intellect invested heavily for next 3-4 years in Sales & Marketing, which was as high as ~45% of revenues. Even investments in R&D were high at 15-20% of revenues. These heavy investments resulted in Intellect continuing to turn losses from FY15 to FY18. Even though Intellect turned profitable in FY18, however Intellect had started capitalizing some part of R&D costs from FY17 and thus that resulted in profits in FY18.

These investments were made from ~300 crores Cash that Intellect received as a part of demerger from Polaris. Intellect also did a rights issue in July’17 to raise ~198 crores. And raise another Rs100 crores from Promoters in Sep’18.

FY19 saw Intellect reaping benefits of its investments with revenues growing nearly 40% to Rs1458 crores and Intellect turning small profits (before tax) of ~25 crores (including Capitalized R&D) even though overall investments in R&D and Sales & Marketing continued to expand. This growth was on the back of iGTB segment gaining market acceptance, such that the revenues of this Segment doubled from Rs343 crores in FY17 to Rs678 in FY19.

FY20 saw Intellect again making losses (considering Capitalized R&D costs) of ~90 crores. This was on account of two reasons, firstly the revenues for Intellect de-grew by 7% as iGTB segment that saw massive growth in last few years witnessed some slowdown.

(One point that I want to highlight here is that License Revenues is lumpy in nature as these are one-time revenues, so if say Intellect would have sold ~250 crores worth of license in FY19 out of Rs678 crores iGTB revenues; in FY20 it would again need to sell atleast ~250 crores worth of license to new customers to grow, which is not easy as same customers will not generate any license revenue for atleast 5-7 years depending on when the existing license expire. So, a sharp spike in revenues would typically mean some slowdown going ahead. Same played out in iGTB)

Secondly, Intellect had started getting SaaS deals from FY19 onwards. In Part-1 we have discussed that initially Cloud deals puts overall revenues & profitability under pressure as there is no license revenue. In FY20, SaaS revenues grew from Rs83 crores to Rs122 crores; ballpark it would mean that ~80-100 crores worth of Licenses were not realized.

So, these two reasons led to lower revenues of Rs1350 crores in FY20 and this combined with operating deleverage (discussed this risk in Part-1) as cost base was roughly same, led to Intellect turning into loss.

Then FY21 was a massive year for Intellect from the profitability stand point. There was all round improvement in Gross Margins and Operating leverage from Sales costs and R&D costs. Even though revenues grew by ~11%, Profits (before tax & after Capitalized R&D) grew to a massive Rs176 crores.

Now one would definitely wonder if this rise in profitability in FY21 was on account of Covid related costs savings and would margins sustain at current levels. I’ll talk about this in detail later on.

Intellect Today

In the Part-1 I had talked about two specific checkboxes for a good software product business-

1. Reaching a stage wherein major product development costs are behind and products are Gaining acceptance, post which a software product company can see non-linear growth in profits as revenues grows faster and cost base grows at moderate pace.

2. Increasing share of License linked revenues of License+AMC+SaaS, which helps improve gross margins overtime. AMC & SaaS further helps improve quality of revenues in terms of secularity & profitability.

Checkbox 1-

Intellect is an IP powerhouse with over 14 products covering nearly all the verticals of BFSI segment. This allows for a wider market opportunity and good cross sell opportunities.

Investments in major product developments is already behind and investments in Sales & Marketing from Go-To-Market maturity perspective is already done for most products segment; iGTB achieved GTM Maturity in FY19, iGCB in FY20, SEEC in FY21 and iRTM is expected to achieve the same in FY22.

Now one would ask how to judge the quality of Intellect’s product and its market acceptance, given that these are enterprise products and not something we as individuals can experience. Well, according to me the best indicator is to look at License revenues; if License revenues continue to grow, then it’s a clear indication that the company is able to sell its products to more & more customers. And it is these license revenues that will build-up AMC in years to come.

Over last 6 years, Intellect has grown its License revenues at a 25% CAGR and this is in spite of getting a large number of SaaS deals recently. (Note: SaaS deals do not have a Licence component)

Another pointer to understand market acceptance of products is to track no. of customers and no. of products per customer. Higher no. of products with the same customer indicates better cross-sell ability.

Another way to gets some insights is to look for Analyst ratings like that of Gartner, IBS etc.

Gartner Reviews for Intellect looks Good-

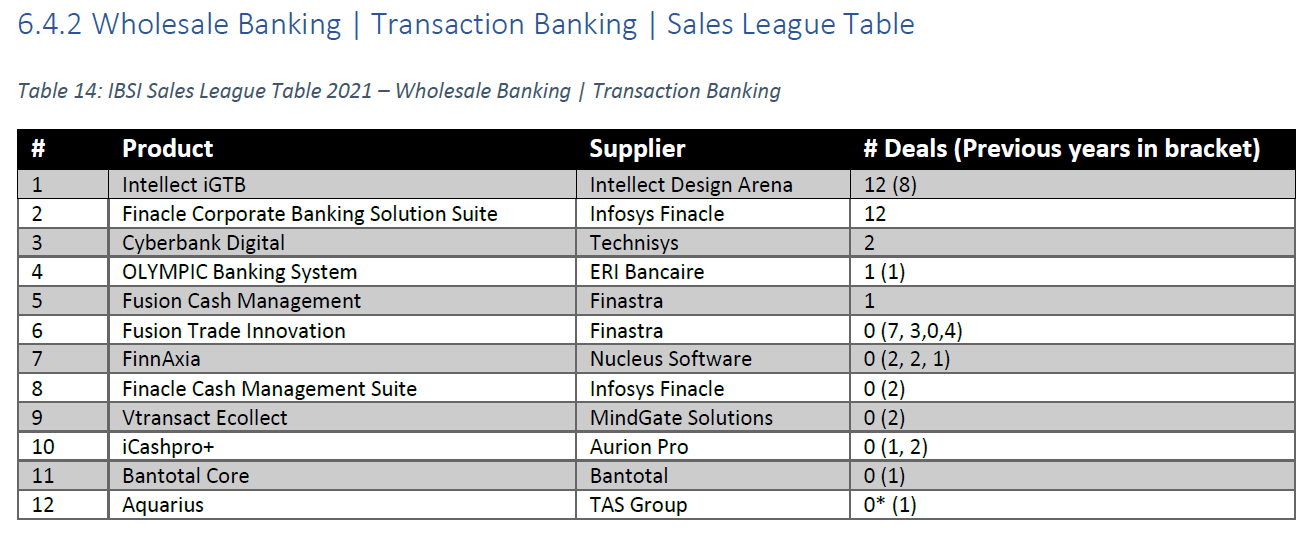

Based on IBS Sales League Table, a lot of Intellect’s products are among top and some of Intellect products are market leader in their category like in Retail Core Banking and Wholesale Transaction Banking. (Note: IBS rankings are based on number of deals.)

Another pointer here is the increase in avg. license value, which indicates ability to close and acceptance by larger customers.

In terms of Investments in R&D and Sales & Marketing, Intellect is seeing operating leverage play out as these costs have moderated over last couple of years.

The thing to note here is that it is not that these costs have reduced in absolute terms, overall cost base have expanded, but relative to growth in Revenues, these costs are not expanding that fast.

This is good indication that operating leverage is playing out not because of savings in costs but because of the acceleration in revenues. Also, in 2019, Intellect had incurred additional R&D in order to make its existing set of products could ready and thus there should not be any major increase in R&D spends going ahead.

Checkbox 2-

Over last 7-years (ie. from demerger), the share of License Linked Revenues (License + AMC + SaaS) for Intellect has grown from 32% in FY15 to 54% in FY21. Within this, SaaS+AMC has grown from 18% in FY15 to 32% in FY21. These are good indications as License Linked Revenues, specifically SaaS+AMC provides for higher gross margins and are more secular in nature.

Intellect’s SaaS revenues have grown from nothing to nearly 12% in FY21 and at current run-rate, it could be as high as 20% in FY22. This increase is another indication of new product lines of iGCB and SEEC gaining traction, as in SEEC 100% deals are SaaS based and iGCB also has most deals on SaaS model.

Looking at above chart, one would say wait a second, the Gross margins have not really improved over last many years except for FY21. And FY21 would have Covid related costs saving right? Well, these are legitimate questions so let’s dig into them.

Antithesis

Gross Margins Improvement-

Crux of the thesis in case of Intellect or any other Software product business is that overtime as your License Linked revenues build up, your gross margins should improve. Based, on chart above, that does not seems to be playing out in case of Intellect.

My understanding here is split into two parts-

1. The period of FY15-FY18. Over these four years the share of License linked revenues did not increased much, it increased from 32% to 37%. So, any major expansion in gross margins would not really happen. But the question that comes to mind is that why didn’t the share of License linked revenues expand much? Well, my understanding here is that it is due to large number of products that Intellect has tried to bring into the market overtime.

The way the business works is that in the initial years of any product the gross margins are low, reason being that one cannot expect to charge premium pricing for a new product, it is only overtime as the product establishes itself that a company can charge higher for License and since AMC is based on License value, lower Licence value also results in lower AMC.

Some of the data points also provides some context around this; Intellect’s gross margins in its iGTB segment (most matured segment) was 60% in FY18 with 52% of revenues coming from License+AMC. Further, iGTB contributed 43% to Intellect’s total revenues in FY18; this indicates that Intellect’s other segments were operating at sub-par gross margins, because if 43% of revenues are coming at 60% gross margins, then remaining 57% of revenues would be coming with lower gross margins of ~40% to get an overall gross margin of ~50% in FY18.

2. Over FY19-FY20, License Linked Revenues saw good increase from 37% to 46%, but still the gross margins did not improve. Here if one looks closely the entire increase in share of License Linked Revenues in this period was led by SaaS revenues, which increased from zero to 9% in FY20. And as discussed in the Part-1, SaaS revenues in its initial years puts pressure on overall profitability given that they do not have License fee. So that could be the reason for the same.

FY21 Profitability Spike- Covid Led Costs Savings?

We saw earlier that FY21 was a massive year for Intellect from profitability point of view, there was expansion on Gross margins front and good operating leverage from R&D and Sales costs. And we have seen many companies getting benefited from Covid related cost savings, so did the same thing happen in Intellect? Well, based on my analysis and understanding, that was not really the case to a good extent.

Having looked at the expenses of Intellect in FY21 vs earlier years, Intellect saved ~60 crores in Travel costs, ~20 crores in Business Promotion costs and incurred ~35 crores of Bad debts. So, net-net, they saved ~47 crores in FY21 vs FY20. Even considering these 47 crores, Intellect still saw operating leverage from Sales & Marketing costs compared to last year.

On R&D costs side, costs only reduced slightly from the high base of FY20 in which Intellect had spent additional Rs40 crores on making its product cloud ready. So, there was hardly any saving in R&D costs.

Now on Gross margins, Intellect saw sharp jump from ~49% to ~56%. This according me is a result of sharp jump in share of License Linked Revenues which grew from 46% in FY20 to 54% in FY21. Further, FY21 was third year of Intellect starting to generate cloud revenues, so the initial pressure from Cloud would have also eased out. So, these two combined could have been the reasons for the same.

There could have been some more costs savings but max what could happen is that in the coming year Intellect might not see any operating leverage play out from increase in revenues as it might cover for costs coming back. But post that, increase in revenues should help Intellect improve its margins.

(Note: This is what my understanding & research has led me to believe, but I could be wrong and/or biased in my understanding)

History of Missed Guidance

This is the real risk in Intellect. Ever since the company got listed in 2014, management has been giving strong guidance regularly and have missed this guidance in most cases.

And such optimistic guidance has continued, in a recent concall and interview Mr.Jain has said that Intellect will grow topline at double digit with a target of $400 million (~3000 crores) revenues by FY25 and that EPS will grow at 30% CAGR.

Even though Intellect has done reasonably well over long run; it has grown revenues at 16% CAGR for last 6 years and overall quality of revenues has improved in terms of growing share of License Linked Revenues, Margins Improvement etc. The problem with such an history of missed guidance is that it becomes very difficult for market to believe in what the management is saying and even when numbers do come out well, it becomes difficult for market to believe the sustainability of such numbers.

Final Thoughts

Intellect as a business has a lot of potential. The opportunity size is quite large given the breadth of products, Temenos runs a billion dollars business primarily from core banking software alone.

A mid-high teens topline growth is possible here. Plus, there is a lot of scope for margins to improve, some of the matured companies in this segment have EBITDA margins as high as 45-50%, Intellect’s EBITDA margins is currently ~25%.

Plus, the business model here is one that compounds in a non-linear fashion after a certain stage with accelerated revenue growth, improved profitability and improved secularity. And most of Intellect investments are expensed in P&L, thus Intellect will generate strong free-cashflows.

Intellect is also relatively lower valued in current market; it currently trades at ~30x earnings which is quite low for a company that can deliver double digit free-cashflow growth for many years to come. In the west, most software product companies trade at 10x sales, Intellect currently trades at ~6x sales.

So, it’s a good combination of Non-Linear profits growth and Valuation Rerating opportunity. Obviously, it comes with some risks around sustainability of margins and execution capabilities.

My investment framework has always been to bet on Trends. In some cases, I bet on Trends that are already established i.e company is delivering numbers, price is trending and market has recognized the trend. In other cases, I bet on potential future trends wherein the company is yet to deliver on numbers and/or price is not trending and/or market has not recognized the trend. In such potential future trends, one ends up taking some higher risk of pre-empting something that market would be interested in future and/or market has a different opinion on; but if right, the rewards in such potential trends is also way higher. Intellect is one such potential trend for me.

One of the things I am looking forward in case of Intellect is Buybacks. Arun Jain has repeatedly said in the concalls that Indian markets does not really recognize the value of IP led software product business and that Intellect is not properly valued. And with Intellect turning debt free with nearly ~220 crores in cash and strong free-cashflow generation, I believe a Buyback is very likely here as Intellect does not really has alternative use of cash.

Ideally, Intellect should go for open market purchase and not a tender offer. A tender offer would not be an optimal use of cash as it would basically provide exit to non-interested shareholders at some 10-20% higher price, whereas an open market buyback would be akin to reinvesting in the business and that too at current reasonable valuations, which would improve earnings for existing shareholders.

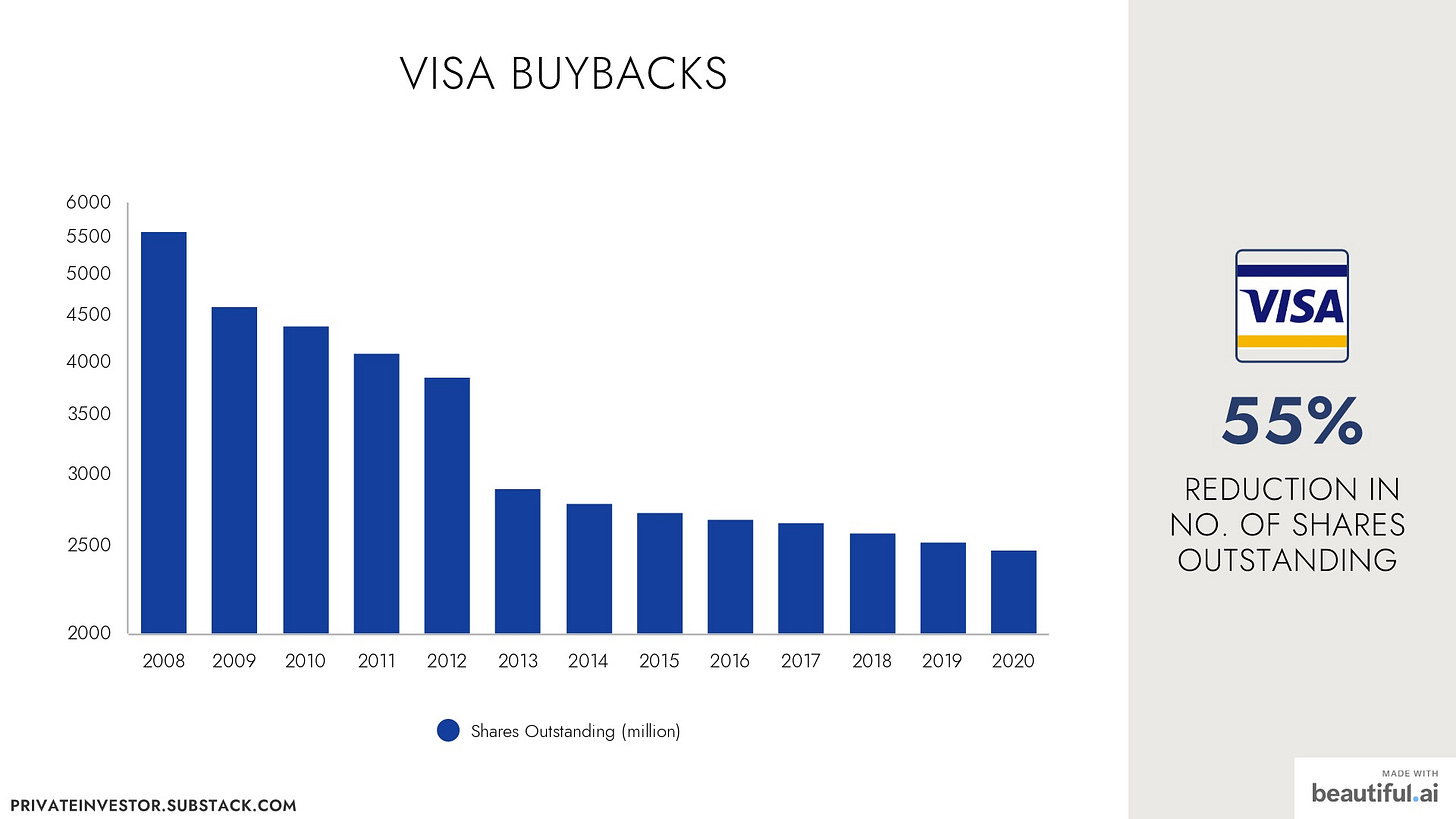

In the western markets, there are so many examples of companies using buybacks to turbocharge returns for their shareholders. Take Autozone (US based autoparts retailer) for example, Autozone has reduced its outstanding shares by 75% in last 16 odd years. Over this same period, Autozone’s profits are up by ~4x, but its EPS (earning per share) is up by whopping ~15x. And this has reflected well in its share price as well, which is up by 17x over same period. Visa is another example that has reduced its shares count by 50% between 2008 and 2020.

That’s the power of Growing Free-Cashflows

So, this mostly sums up what I wanted to share here. Feel free to post your queries in comments below.

Wow.. that was better than SOIC article.

Really loved the article sir

Thanks for putting this hard work and hours of research into such a beautiful way

From CA Mahesh Vora,Mumbai

Ankush Agrawal,

Very well studied and explained in detail the company as compared to reports published by ICICI securities or any other. You have done lots of efforts in putting such article on one company and I wish you come out with more companies where you see more potential to grow due to "Atma Nirbhar". It is good practice not to put any target price as you have explained us the business. Your reply on comment on Management is excellent and well explained. If Mr.Jain want to remain in Stock Market with his image and goodwill he will do it with improving numbers rather than other tactics. Well explained the comment as past is not future and not necessarily repeated. How do I know about publishing your next such detailed Article ? Can I by subscribing through Email ? All the best for your article by educating investors.It seems you have passion for writing such detailed article?