Hey! This is going to be a series of posts wherein I am going to talk about why Software Products is a great business model and also about Intellect Design Arena which is a pure-play software products company competing in Global Tier-1 BFSI (Banking, Financial Services and Insurance) software market, along with its future possibilities.

The first part would revolve around understanding the Software Products business model, why it is a business that gets better with size and a major pivot undergoing in Software Product business model.

Before we dive into the Software Product Business let me set the right context by giving you some insights on how a business run on the back of intangibles (IP, know-how, Patents, rights etc) is different from a business run on the back on tangibles (land, machine, labour etc).

The primary differentiation is that a tangible asset can be used by a single user, while an intangible asset can be used by many users at the same time. So, if a company manufactures machinery, it can sell one machine to only one customer whereas if a software company creates a software, it can sell the same software to everyone. Basically, the crux is that in case of intangibles led businesses one can recreate additional units of product that one is selling quickly & without much incremental costs/efforts/time; wherein in case of machinery, creation of every new unit of machine would require similar level of costs/time/efforts. And this is wherein the economies of scale comes from and makes such intangibles led businesses more scalable & profitable from a tangible business.

Software Product Business-

Most of us are aware of IT Services business basically your TCS, Infosys etc who provide various services around IT like software development, software testing, IT management etc. IT Services basically is a human resources game wherein these companies are leveraging better availability of talent pool to provide such services. Even though it started primarily as cost arbitrage it has overtime also grown to some bit of technical expertise & scale led value addition as well. But in broader scheme of things, it is primarily led by manpower.

In contrast to IT Services, IT Products is an IP (Intellectual Property) led play. Here, the companies are developing software products which are then sold/licensed to others. The beauty here is that once the product is developed & has gained acceptance in the market, the incremental growth does not require incremental costs & scale, one basically have to create a copy of the software for each new client and thus you have Operating Leverage built into the business. Whereas in-case of IT Services, incremental growth has to come from increased scale (primarily manpower) and thus there is hardly any operating leverage at play.

A typical business transaction in Software Product business has three elements-

A company sells its product to its customer on a License basis for an upfront License Fee. These licenses (basically right to use) typically are long term in nature 5-7-10 years or in some cases perpetual as well.

Once license is sold, there is a phase called Implementation phase wherein the software product company helps its customer setup the product & get it running. This could include training on how to use the product, integration with client’s other products/systems and some customization as per client’s need. This part of the business is basically your IT Services in nature, wherein operating leverage is not possible given that each implementation requires equal efforts, even though some efficiencies could be built over time by implementing the same product for similar types of customers with similar requirements; like in case of a banking software, implementing a product in the same country again & again would require less efforts given that one is already well-versed with modifications required to meet that specific country’s regulatory requirements.

Post this implementation ie. after the product has gone live at customer’s end there is something called AMC (Annual Maintenance Contract) that comes into play. Under the AMC, the software product company provides on-going support, smaller updates & bug fixes to the customer. AMC is active till the time a customer is using your product and is paid annually (mostly in advance). AMC is typically 20% of License fee in value. So, if a software product company sells license at say $1 million, then it would make 20% of that ie. $0.2 million each year in AMC till the time the customer uses your product which is long term in nature.

This is where the beauty of IT Products business comes from. AMC is basically free money in the sense that you have little to no costs attached to AMC revenues and they are long term & annuity in nature. So, overtime as software product business matures, your AMC revenues continues to build up on the back of licenses that you have sold in the past. Further, your quality of revenues improves as these are higher margins & more secular revenues.

This is over the fact that, incrementally the License that a company sells also comes at little to no costs as you are basically providing a copy of software that you have already developed by investing heavily in early stages of the company. This is not to say that incrementally there are not costs involved, as there is continuous R&D involved in upgrading the products, but the amount is miniscule compared to the revenues to one generate incrementally by selling the same software & collecting AMC on the same. License & AMC together are called License Linked Revenues.

Now the above discussion was around software development & implementation costs which is the primary cost line for a software business. Revenue net of this is your Gross margins in a Software product business. Overtime as your share of License Linked Revenues goes up and share of Implementation/Services revenues decreases, the gross margins expands.

The second largest cost line for a software product business is that of Sales & Marketing. If a new product has to compete with an existing product in the market, then it would require tremendous brand & awareness creation. Imagine someone wanting to compete with say some of the software that you use like say Excel, Chrome etc.

And this is even more difficult task for an enterprise software wherein the software is being used to run a business specifically in the BFSI space wherein the software is handling money related matters. So, getting the initial traction & awareness and acceptability of your products requires a lot of investments in Sales & Marketing.

Here as well, a software product company enjoys operating leverage because post the initial phase wherein you get some traction of your product with some customers, it becomes relatively easier to sell incrementally as now you can demonstrate the success of your previous customer in using your software. And this compounds overtime as your existing customers becomes a reference point.

Most product companies also have multiple products, so if you have a customer who is using one product, selling more products to the same customer requires very less efforts. And after the term of existing license expires, if the same customer again wants to continue with you, the sales efforts are literally zero for the second time you sell License to the same customer.

Another good thing about Software Product business is that most of your investments which is your R&D and Sales & Marketing is done through PnL and thus you get large free cashflow generation. In markets, growing free cashflow is the holy-grail from the valuations point of view, which is the reason why FMCG companies gets such high valuations. Most of the software product companies use this free cashflows either to buyback its own shares (which is basically equivalent to re-investing in itself) or for acquisitions, both of which further adds to growth of the business.

Take a look at how Temenos (A leading Core Banking software company & a competitor of Intellect) has grown over last decade. It is a good example of how a Software product business can evolve overtime.

Even though initial part of last 10 years was not good for BFSI space due to Global Financial Crisis of 2008-2009, Temenos has doubled its revenues from ~$448 million to ~$900 million.

At the same time its EBIT has nearly tripled from ~$112 million to ~$318 million. Temenos has seen its margins expand year-after-year for nearly a decade now from ~25% in 2010 to ~36% in 2020 on the back of increasing share of License linked revenues (License+AMC+SaaS) and operating leverage from R&D and Sales & Marketing costs. Share of License linked revenues have expanded from 70% in 2010 to 82% in 2020.

Temenos has further guided that it expects continued improvement in its margins from current 36% to 41% by 2025.

To put it simply, in an IT products business you have the following stages-

SaaS- Supercharging A Software Product Business

Our above discussion of Licence Fee, Implementation and AMC was around the traditional business model of how software is sold. But at the start of last decade, a new business model has emerged in the software business called as SaaS (Software as a Service).

In Investing In Complexities, Non-Linearity and Optionality post, I had talked about Evolution of Business/Strategy as a source of Optionality. This Optionality plays out when a company’s existing business evolves or pivots to a better version of itself. Such pivot allows a company to increase its growth, secure market leadership, increase profitability, increase scalability of business etc. Basically, the way a business is done is changed.

SaaS is one such optionality for Software Products industry.

Under SaaS model, instead of charging upfront License and then collecting AMC over the years, the software is sold as a service wherein the customer can use the product which is hosted on the cloud by the software company by paying a fee on a recurring basis say monthly or annually.

Emergence of SaaS has helped software products business in two aspects-

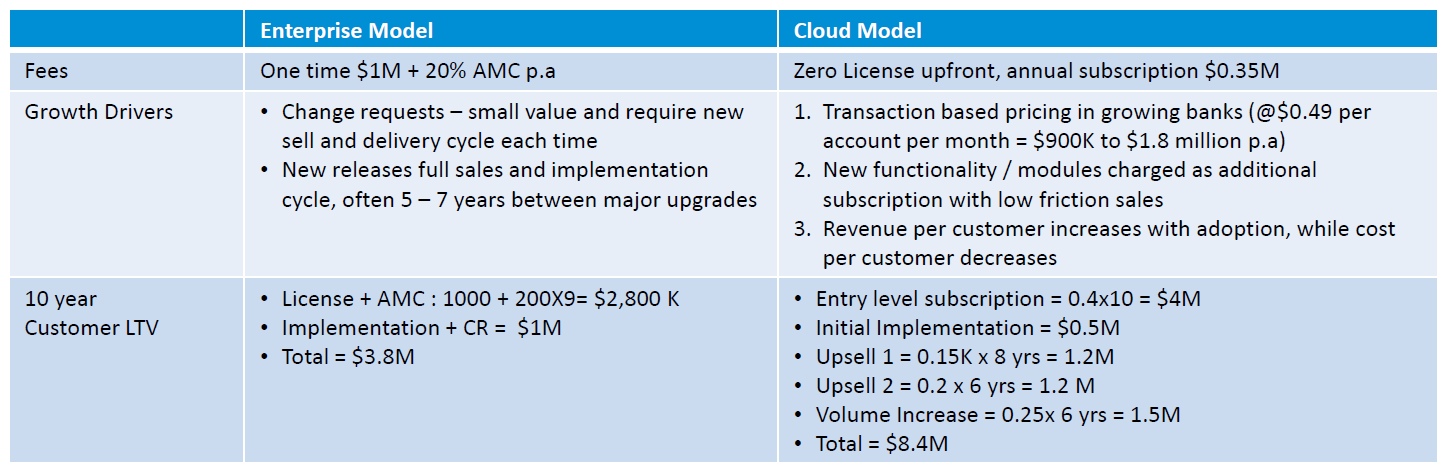

1. It has increased the LTV (life time value) of a deal, adding to profitability & growth

The whole premise of SaaS is that instead of a customer investing upfront by buying License which costs large sums of money, the customer would be happy paying small sums of money on a regular basis for the same software. Consider this as buying a car by paying cash upfront (traditional model) vs buying a car on EMI basis (SaaS). And we all know that that total cost of Car would end up being higher in case of EMI vs paying upfront. Similar thing is being played out in SaaS, wherein the LTV of a customer has almost doubled over a 10-year period.

Further, SaaS model also allows for upside possibility in the sense that in some cloud deals the pricing is set not as a fixed fee but is based on some metrics like say in case of a banking software- number of accounts, number of transactions etc. This allows for upside possibility from the growth of your customer’s business.

2. It has increased the predictability & reduced the volatility of revenues

In the traditional License model, there was lumpiness in revenues. As & when a License was signed, there was a huge one-time inflow in form of License Fee post which AMC would kick in only after a lag of nearly 12-24 months. This is because, AMC is typically due post implementation phase which can vary from couple of weeks to couple of quarters depending on nature of the deal.

But in case of SaaS model, we have a fixed monthly recurring revenue on a regular basis and thus it reduces the volatility & increases the predictability of revenues.

However, one of the drawbacks of SaaS is that initially during the transition phase of License to SaaS model, there is pressure on revenues and margins given that unlike the traditional model, SaaS mode does not have an upfront License Fee which is typically pure profit, but the implementation costs are the same and thus initial profitability is low.

In totality, SaaS considerable improves the quality of revenues of a software company in terms of more secularity & predictability and also overall profitability and thus SaaS revenues typically command higher valuation multiples in the markets.

One of the best examples of how SaaS model has helped a software business is that of Adobe. Adobe as most of you know is the company behind Adobe reader and Photoshop and various other products around content creation & publication.

During 2008-2009 financial crisis, Adobe was hit hard as its revenues fell 20% and valuations fell over 60%. One of the primary reasons for the same was that till that time Adobe’s recurring revenues were just 5% of total revenues and rest entire revenue was dependent on its customers buying its expensive products which used to cost hundreds of dollars. Most of the customers were happy not paying these top dollars for a newer version of the product and continuing with older version and thus market was not sure if Adobe will be able to sustain its revenues and thus a large fall in valuations.

Adobe’s management in 2011 made a decision to transition from the traditional license model to SaaS model wherein the company started offering its products for as low as ~$10 per month on a subscription basis. This shift had major impacts on Adobe’s business-

1. It allowed Adobe to finally get back on growth. Before 2011, Adobe was selling 3 million units of its creative software under traditional licencing model and that had remained flat for a long time. Revenue growth was largely on account of increase in selling price. This obviously was no longer sustainable as it deterred new users to buy an already expensive product. SaaS model allowed cheaper & flexible access to Adobe’s products.

2. It allowed Adobe to build sustainable revenue stream wherein it was no longer dependent on its customers shelling hundreds of dollars every time to upgrade product to a newer version of the product. Adobe’s subscription revenues have grown to ~$10 billion and constitutes >90% of its total revenues now.

This increase in growth & sustainability of revenues have done wonders for Adobe’s share price which is up ~20x since it began its SaaS transition.

If you are looking for more qualitative insights into how SaaS model has helped Adobe; do read-

1. https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/reborn-in-the-cloud

2. https://www.dprism.com/out-of-the-box-into-the-cloud-adobes-transformation-success-story/

Adoption of SaaS model started with consumer software products and is now gaining traction in the enterprise software market as well. Temenos and Intellect both now have ~10-15% of their total revenues coming from SaaS model; from nil 3-4 years back. And these revenues are growing at >50% year-after-year.

In totality Software product is a business wherein one gets better with size overtime. But there are some risks involved as well.

Firstly, if a product fails to gain traction, then all the investments made into Product development and marketing goes down the drain. And this is the risk with all Intangibles led businesses.

In case of a tangible business, if things don’t work out one can get some money back by selling assets like machinery, land etc. However, any investments made in R&D and Marketing of an obsolete software has Zero value. So, even though intangibles led businesses can grow faster that tangibles led businesses, they can also become obsolete and degrow faster.

Secondly, operating leverage also works in reverse, so any slowdown in revenues would have a much larger impact on profits.

So, whenever we evaluate a software product business, the primary thing to understand is the market acceptance of a product and the traction that the product is seeing. Growing license revenues is a clear indication of a product’s market acceptance as it indicates that new customers are willing to buy the software and old customers are willing to continue/upgrade with company’s software. And it is these License sales that would build AMC revenues going ahead.

Secondly, a company with multiple products is a safer bet given that any slowdown in demand for a particular product does not have a larger impact on overall revenues and that the company has a larger addressable market to grow.

In the next part of this series, I’ll talk about Intellect Design Arena which is pure-play software products company competing in Global Tier-1 BFSI (Banking, Financial Services and Insurance) software market, along with its future possibilities.

great work..

Very informative article. Thank you so much for your efforts!