TIPS Industries: 3-5x Optionality Play

Evolution of Music Industry and Extremely Lucrative Opportunity for Music Companies

Hey there! In one of my earlier Post “Investing In Complexities, Non-Linearity and Optionality” I had talked about how Evolution of a Business is a Rare Optionality.

In the same post I had also stated that such evolution is playing out in the Music Industry. In this post, I’ll discuss in detail how the Music Industry has evolved into an extremely lucrative business and How Tips Industries can be a big investment opportunity here.

The reason why such Optionality results in a great opportunity is because, not only does the evolution of business results in Strong Earnings growth, but also due to the fact that before such pivot, the business is generally in a bad state and thus this transition from a bad business to a good business also leads to massive rerating.

And Strong Earnings + Rerating is all that you need to get Multibaggers.

Evolution of Music Industry

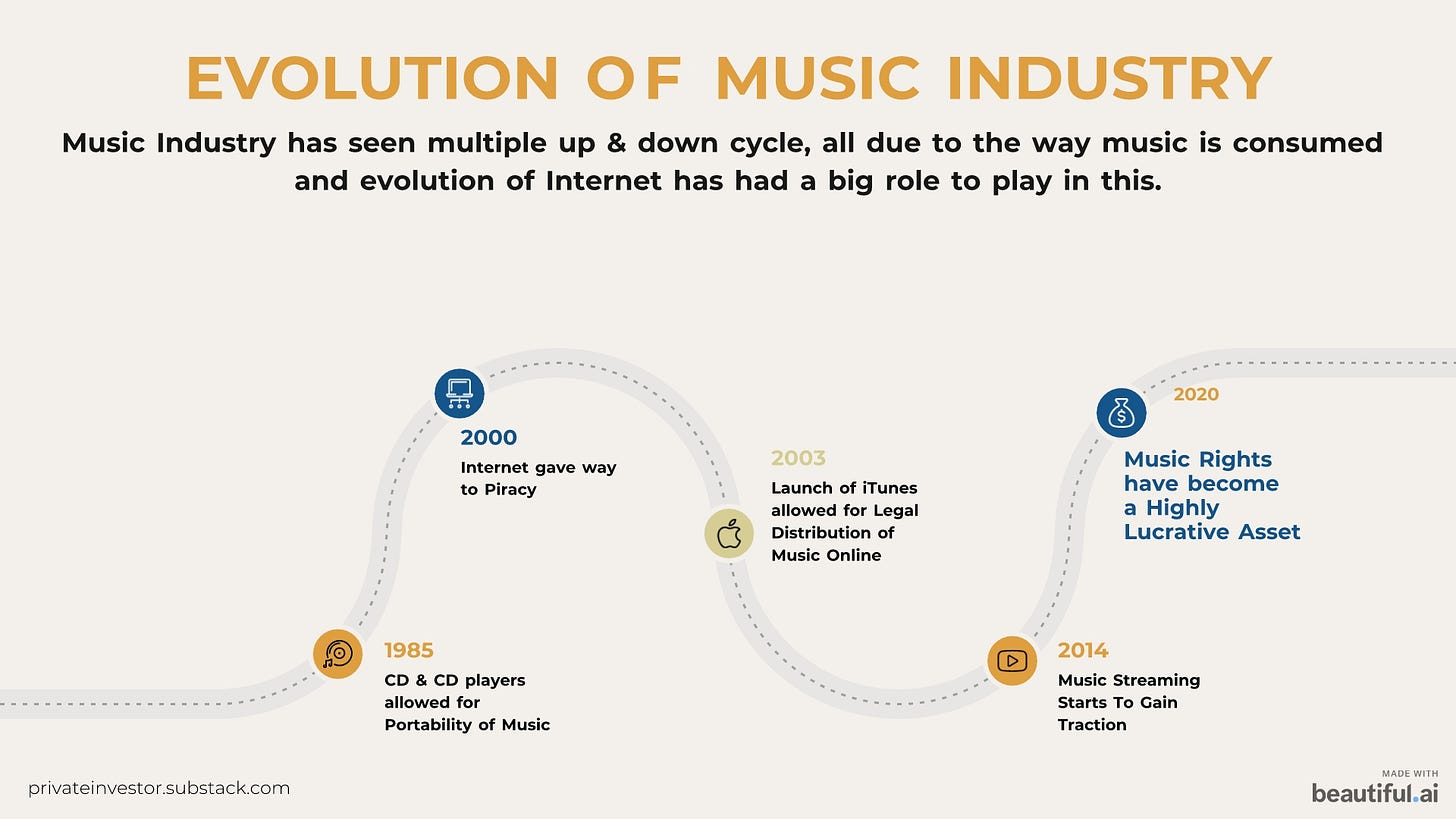

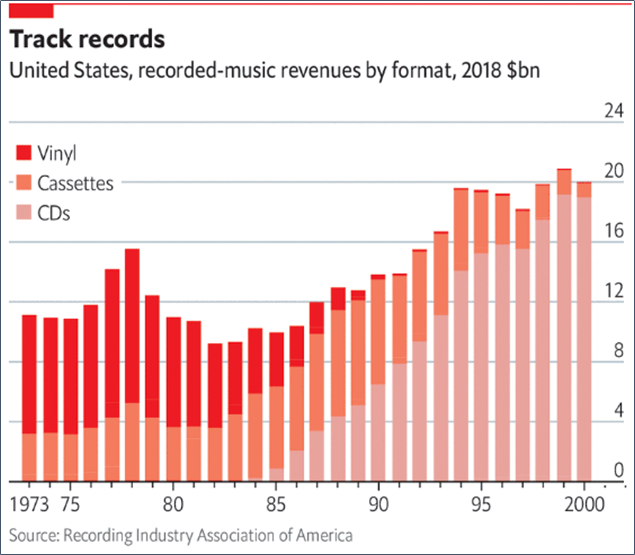

Till 1985, Music consumption was dominated through the mediums of Vinyl and Cassettes. Vinyl was not a portable medium and Cassettes had its own challenges with no. of songs it could store and reliability. With the advent of CDs and CD Players, CDs became the de facto medium to consume music.

From 1985 till 2000, CDs not only replaced Cassettes and Vinyl’s but also led the growth in the Music Industry on the back of ease in the way music could be consumed. Thus, till 2000 music industry had been on a roll, it had experienced 15-20 years of growth.

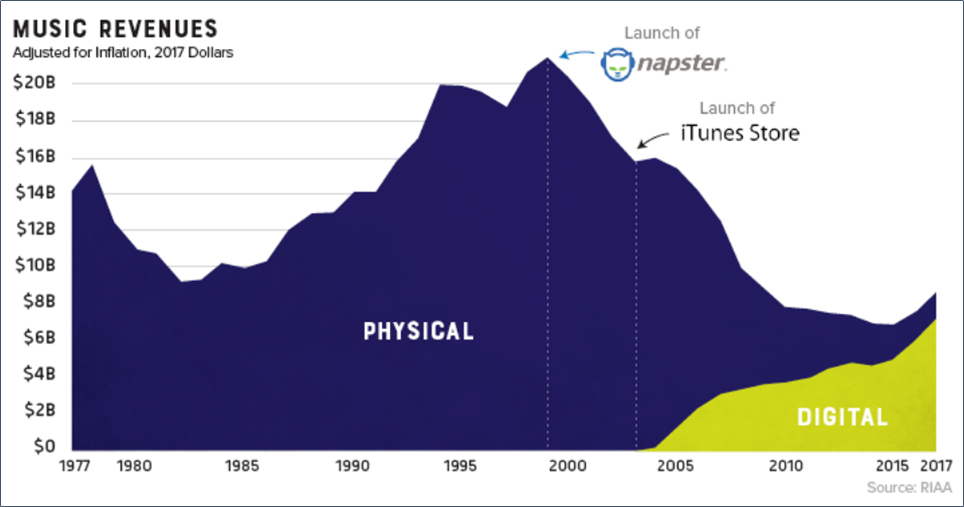

But this all changed with the launch of Napster in 2000. Napster was a file sharing service that allowed people to download and share music over the internet.

Even though Napster was shut down in 2002, but the damage was done. Digital consumption of music had become the norm and it was not possible for the Music Industry to prevent piracy of their music over the Internet.

Music Industry did try hard to find a way to legally distribute music over the internet and get people to pay for it; but failed. This was largely because they were focusing on a way such that their existing profitability from physical sales will not get affected; but getting profitability similar to that of physical sales was not possible in the digital era.

However, one company was able to succeed in creating a service for distribution of music online and that was Apple. Apple launched iTunes in 2003. Apple was able to solve the biggest pain point in online distribution of music, which was the cost. See Music industry was trying to attain the same level of profitability as their physical CD sales through the online medium; but such pricing could not compete with online piracy which was free. The Ease vs Cost matrix was not good enough for people to pay for music.

Through iTunes, Apple provided a simple service to consumers that allowed them to buy music cheap. iTunes allowed consumers to buy individual tracks of their choice rather than the entire albums that music industry was used to selling. Plus, iTunes priced each track at a very affordable price of less than $1.

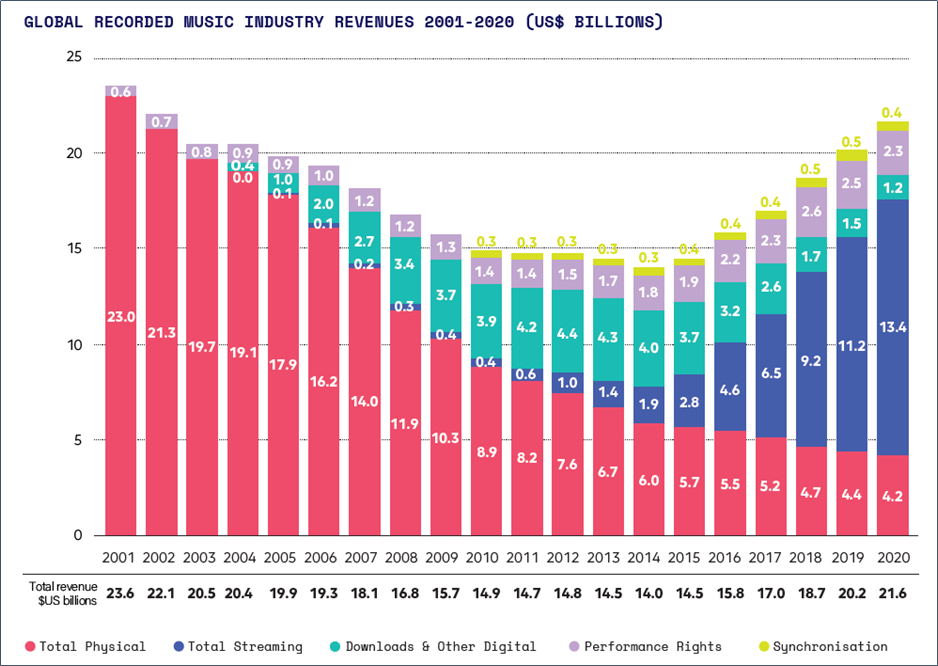

Even though iTunes was a major success and did moved consumption of Music to online service that generated revenues for the Music Industry, but overall industry continue to de-grew; because gone were the days of high profitability when Music Industry could distribute their content through $20 CDs.

So even though iTunes led to Digital distribution as a source of revenue for the industry, overall industry continued to de-grew till 2014.

Emergence of Music Streaming

Streaming is the latest evolution of the Music Industry. Steaming has again altered the way music is consumed. Consumption pattern has changed from buy, download and Consume specific music to something what is called as Access based consumption, wherein entire library of songs is available for consumption on a click and that too for free.

Streaming has created a business model wherein music can be consumed by people for free, but still generates revenues for the Music Industry. And this has been made possible on the back of bloodline of Modern Internet Economy- ADVERTISMENT. Advertisement has had such an enormous impact on business models and innovation through internet which is beyond what most people can think of. Multi-billion-dollar companies like Google and Facebook have existed purely on the back of Ads.

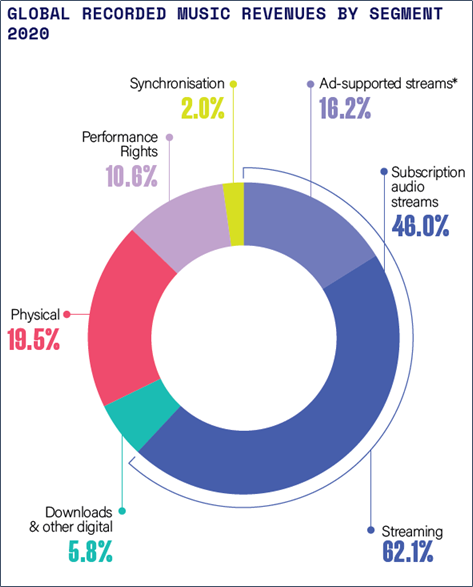

Even though Ads constitutes only ~25% of streaming revenues, rest 75% comes from Paid Subscriptions; Free access through Ads model has been the key factor in altering the consumption pattern of music from Downloads to Streaming.

Strong growth in steaming has allowed Music Industry to start growing again after nearly 15 years of slump and the Industry is now back to its Peak levels of 2000.

What Does This Evolution in Music Industry Means for Music Labels Like Tips Industries?

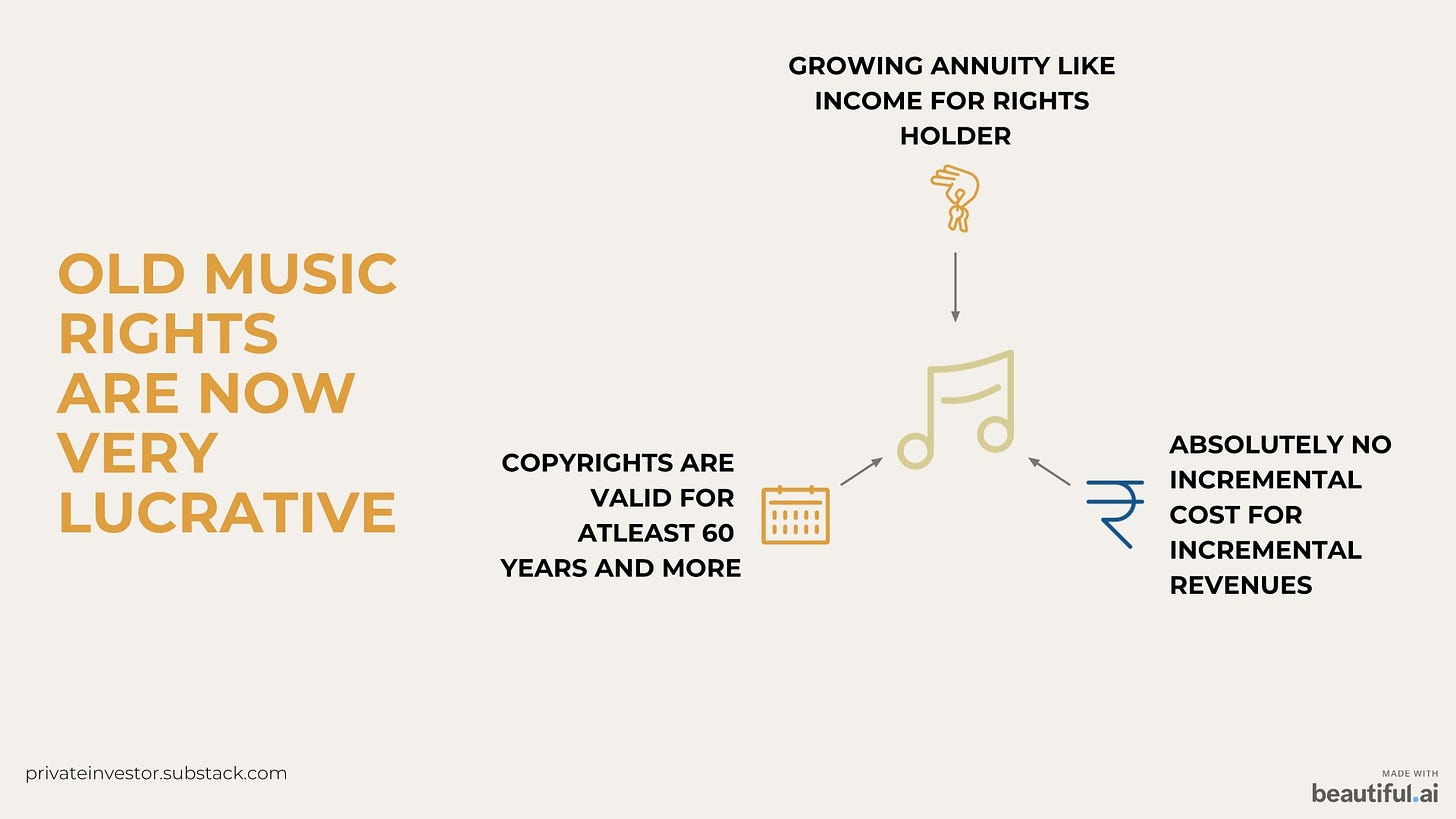

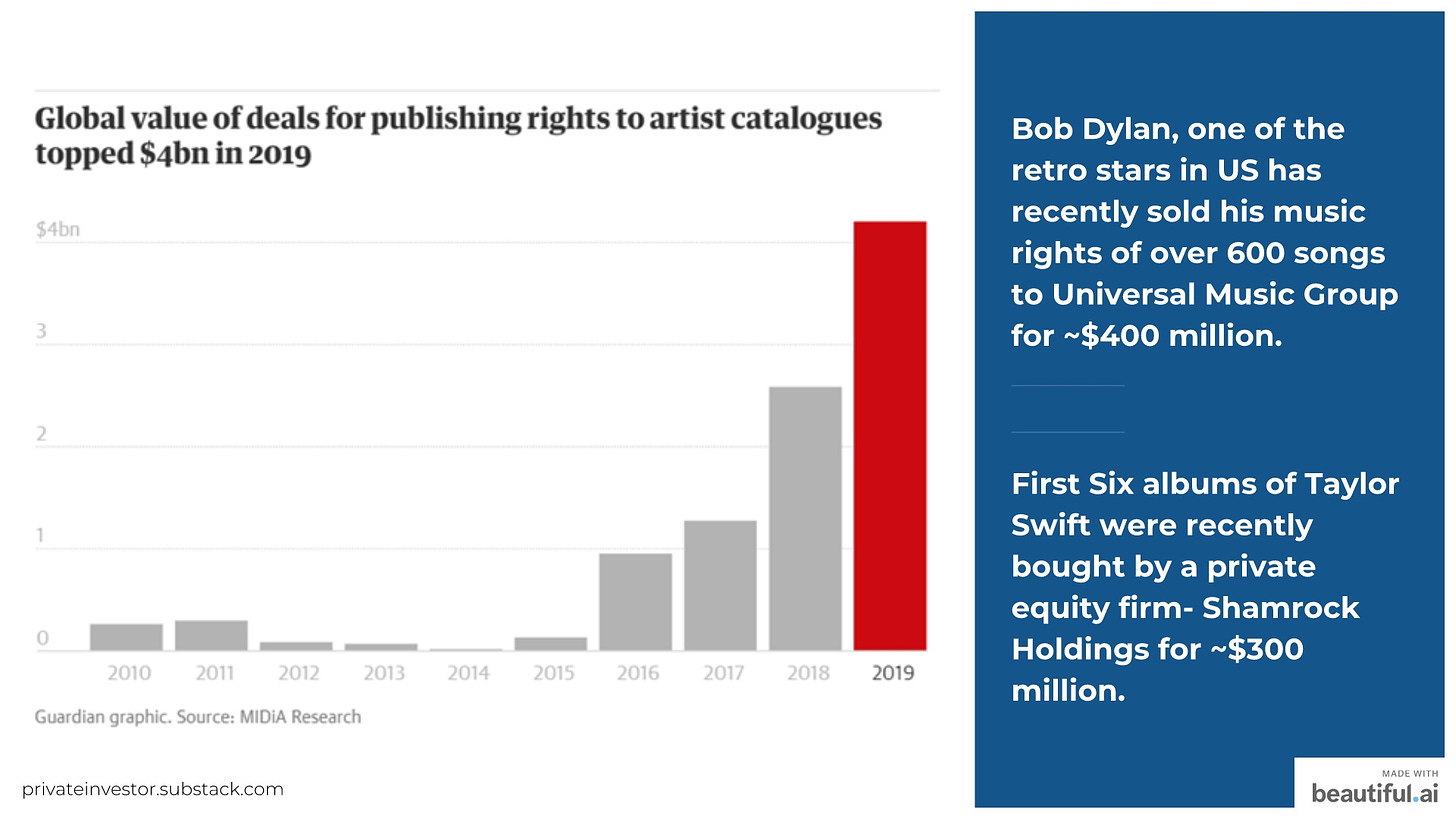

Well to put it simply, Music rights has become a lucrative asset to own. And this is where the old music labels are in extremely lucrative situation. See pre 2000s, in the physical era, it was very important for an Artist to assign copyrights to a Music Label, because Music label played a key role in entire marketing and physical distribution of music through their established network. Post, 2000s music was not that lucrative as we discussed above and thus these rights came relatively easy & cheap.

And the value of these rights is evident from some of the recent deals that has happened globally.

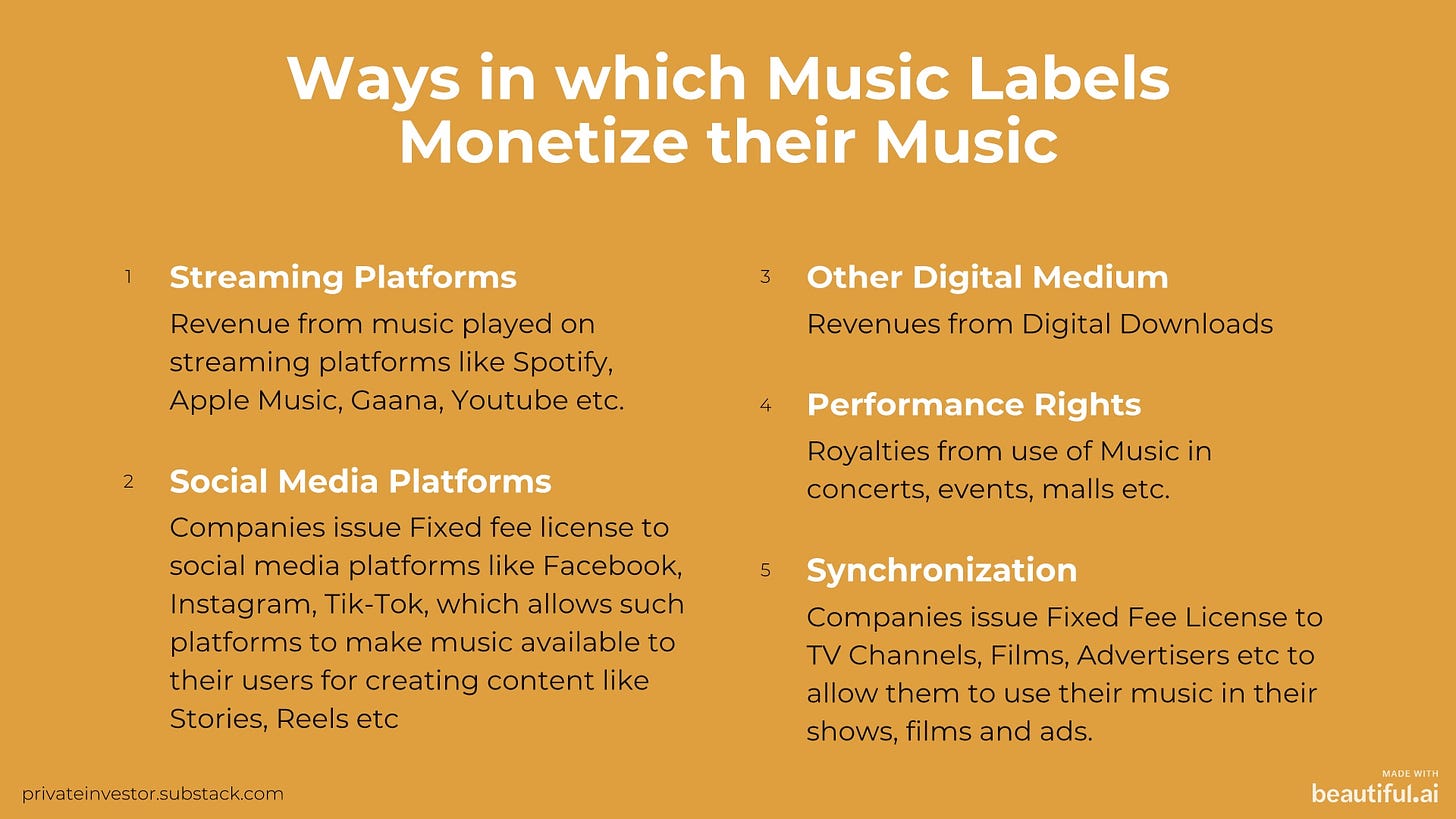

How Does Music Labels Monetize Their Rights?

We will focus primarily on Streaming because that is nearly 2/3rd of Indian Music Industry revenues and it is what is leading to Industry growth.

Streaming platforms like Spotify, YouTube, Gaana etc. all make money in two ways- Advertisement between songs in case of Free Users and Subscription Fees from Premium Users.

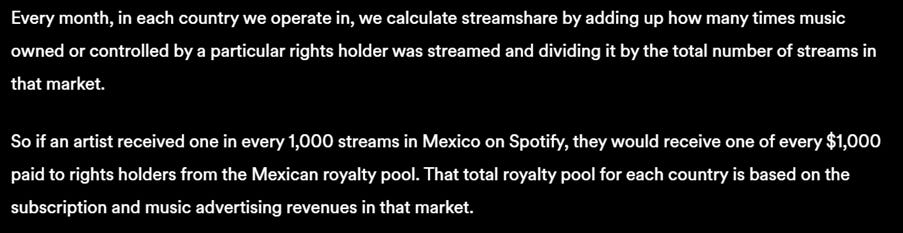

One of the biggest misconceptions that people have about Music Industry is that Streaming services pay Music Companies on per stream basis. This is absolutely not true. The way streaming services pay Music company is based on a Pool of money which is distributed between all the Music Companies based on their share of streams in the total number of streams on the platform.

The size of the money pool depends on the revenues of the streaming platform. Streaming platforms contribute nearly 2/3rd of their revenues (Ads+Subscription) into this pool.

Spotify has this website wherein they have shared good resources on the economics of music streaming- https://loudandclear.byspotify.com

Such way of monetization is highly lucrative for Music labels because increase in their revenues does not necessarily has to be driven by ever growing numbers of streams. For example, I am currently using Spotify as a free user and consuming music specific number of times; if tomorrow I convert to a paid subscriber, the pool of money for music labels expands and thus their share of revenues without any increase in music consumption by me. Also, me converting to a paid subscriber is beneficial not only for the music labels whose music I am consuming, but also for all other music labels whose music I don’t even consume, because they will continue to receive their stream share of the increased royalty pool.

The Investment Opportunity

When I read and researched about this massive opportunity in Music Industry, I was keen to find out how can I best invest in this opportunity in the Indian Markets.

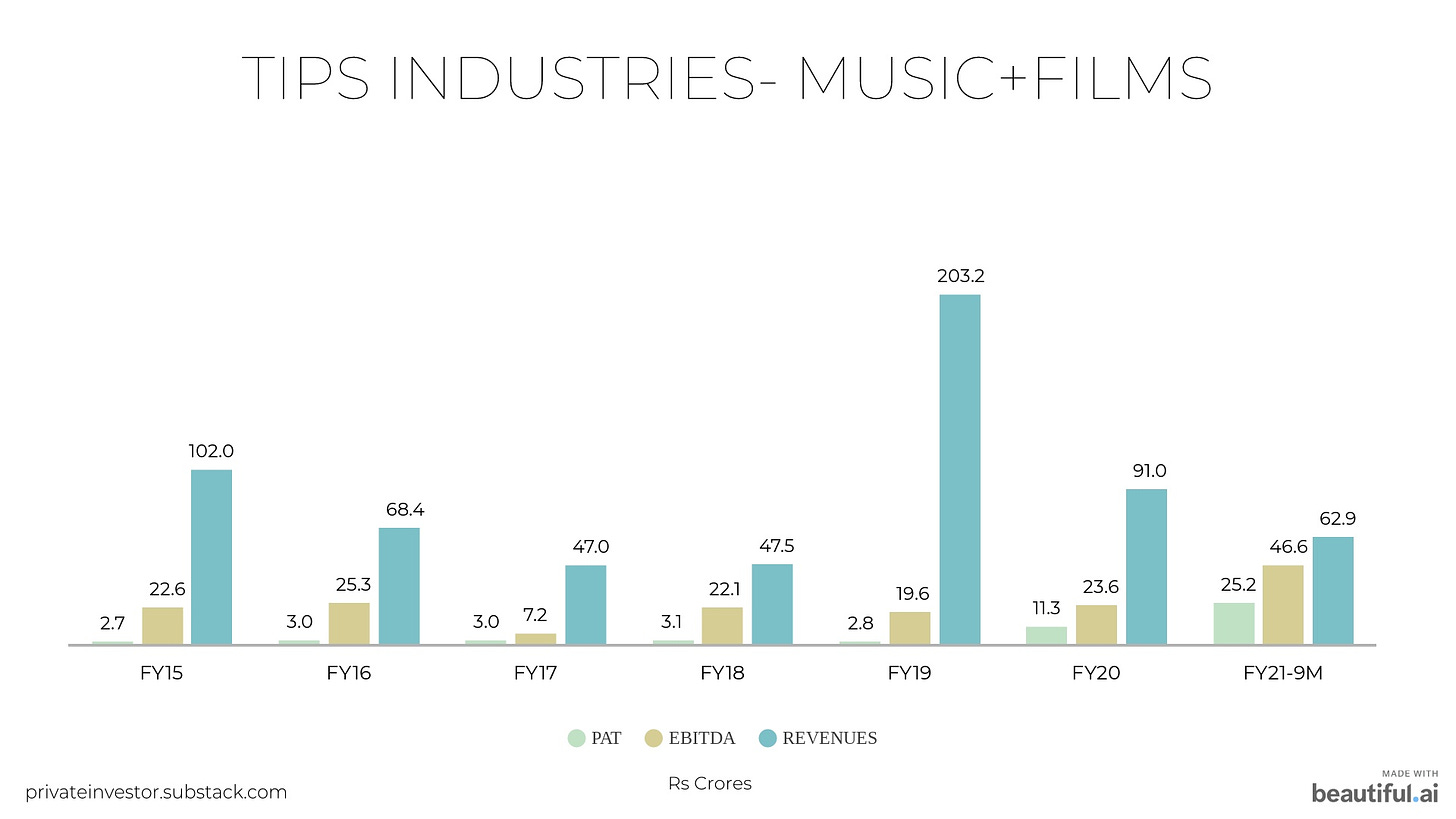

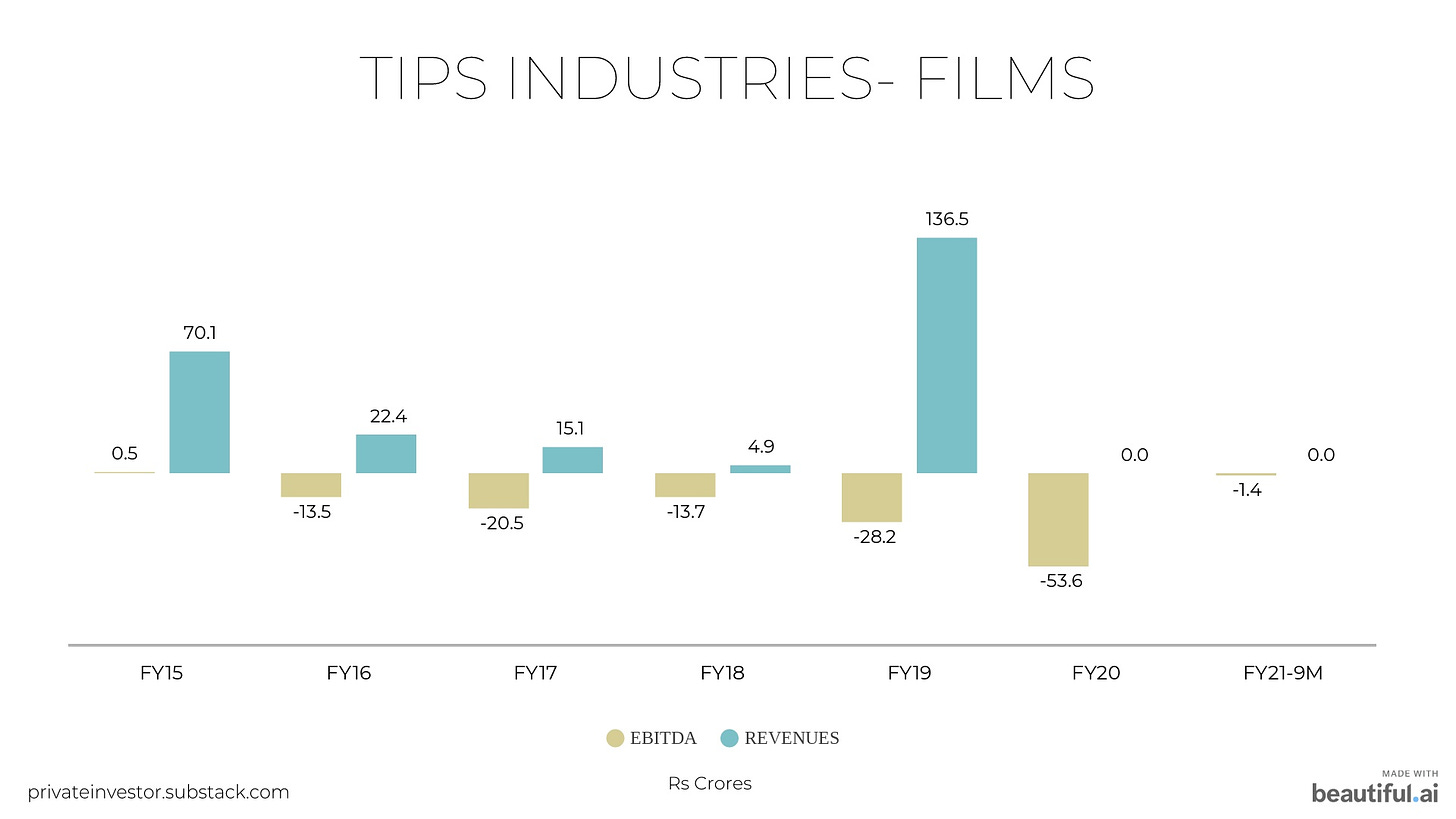

The initially search was a bummer because the leading Music Labels in India like T-Series and YRF Music are unlisted. In the listed space we have two options of Tips Industries and Saregama. But there was one big issue in both these companies, along with having Music License business, both of them had other bad businesses, which would prevent them to properly realize the value of their Music Rights; because markets do punish heavily for a bad business, irrespective of how good the other business is.

But as luck would have it, Tips announced in Feb’21 that they are looking to demerge the Films business. This was music to my ears and felt like the Suven moment all over again. (Click here to read how Suven saw big value discovery from demerger) And Tips has approved this demerger recently.

This will be a major value discovery event as market will realize the true nature of Music Business. Film business not only suppressed the profits of the music business, but it also resulted in huge lumpiness with Films revenues as high as Rs100 crores in few years and near Zero revenues in few years.

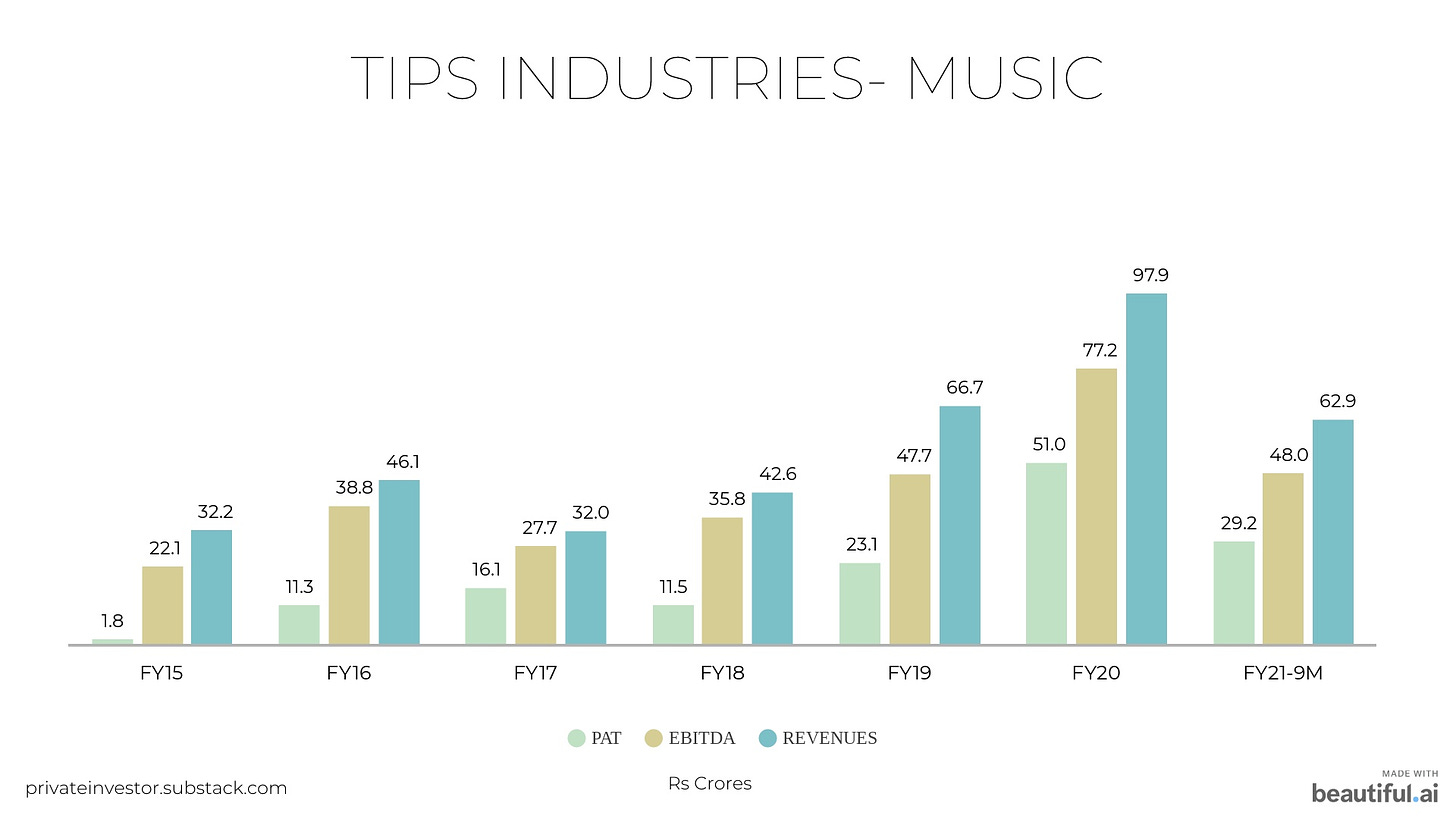

Music business has always been highly profitable with whopping 70-80% EBITDA margins and ~50% PAT Margins.

I believe that TIPS will see Non-Linear growth in its Music business profits as the entire incremental revenues will flow to the bottom line; there are no incremental costs in the business except for some increase in new music acquisition cost which is the only major cost of the business.

Company has recently signed a deal with Warner Music, wherein Warner will distribute Tips Music to major streaming platforms like Spotify and Apple Music. This will be big from the monetization point of view given that Spotify and Apple music are two largest streaming platforms and thus Tips will now have a share in their large royalty pools.

In my opinion a highly profitable growing annuity type business with 50%+ net profit margins and >100% ROCEs will at least get 50x multiple in the current market if not more. TIPS currently has a market cap of just ~1000 crores, so there is huge scope of value discovery here based on current level of profits itself. Excluding the loss from Film business, TIPS made a profit of Rs50 crores in FY20. This year, they should end somewhere near the same number as initial quarter of FY21 was lower.

Further I believe that there is a real possibility that TIPS can become a billion-dollar company in the medium term. Music streaming has big runway in India given that paid subscriber base on streaming platforms is still very low. So, royalty pools in India will expand and so does the revenues of music companies like Tips. Music streaming revenues is already growing at 20-25%.

Few Hurdles from Medium-Long Term Perspective

New Content Acquisition

Both TIPS and Saregama are old music labels with dominant share of retro music catalog. TIPS own rights to over 29,000 songs and Saregama owns rights to 130,000 songs. Even though these are old songs, but they still highly monetizable. This is evident from the fact that 70% of Saregama’s Music license revenue comes from songs recorded before 2000 and 40% from pre-1980s songs; and Saregama’s Music License revenues is ~280 crores.

Further, these companies also have the ability to recreate old songs, gain rights to such new songs and thus increase the monetization for their old catalog.

But new music rights acquisition is important to be able to be relevant in the long run and these new rights will not come cheap. Everyone from Artists to Film Producers are now cognizant of the value of music and thus new music rights might not be that lucrative as it had been in the past and the competition will also be high. Both Tips and Saregama has highlighted their intention to increase spends and focus on new music acquisition. Tips management has stated that they are looking to double their budget from ~15 crores currently to ~30 crores.

Changes in Copyright Act

Section 31D of Copyright Act allows for compulsory licensing of music to broadcasting organizations like Radio and TV. This basically means that a Radio is allowed to use the music owned by Music labels by giving a prior notice and paying a specific royalty. This royalty was earlier fixed at just 2% of net advertisement revenues for Radio companies. This section has been a major contention point between streaming platforms and Music companies on what is included in broadcasting. Streaming platforms have tried to invoke this section claiming that broadcasting includes Internet broadcasting and thus they have the right to use the music without getting into separate royalty arrangements with Music companies.

Tips had earlier won a case against Wynk Music wherein court has ruled that broadcasting does not include internet broadcasting.

Even though this is an extremely long tail event, but there is possibility that the act might be amended in the future to include Internet broadcasting, in which case Music companies will have to settle on the royalties fixed in the act, which might not be as high as the current nearly 2/3rd of revenues that streaming services share with Music labels.

Hi Ankush, Great insight and classical analysis on the Music industry and TIPS as a company. it would be good to see your thoughts on the quality of management of TIPS and the ability to execute non-linear growth. Thank you once again.

Very interesting and informative presentation Thanks for sharing and compiling the information 👌